Manage your debt

- Credit card repayment calculator

- Home loan repayment calculator

- Debt consolidation

- Guide to managing debt

It's FREE

Totally Secure

Takes 2 minutes

Won't affect your score

Your credit score is free and you can check it as many times as you want.

If your score changes, we'll update you too.

You can also access your entire credit file. This includes your credit enquiries, defaults and infringements.

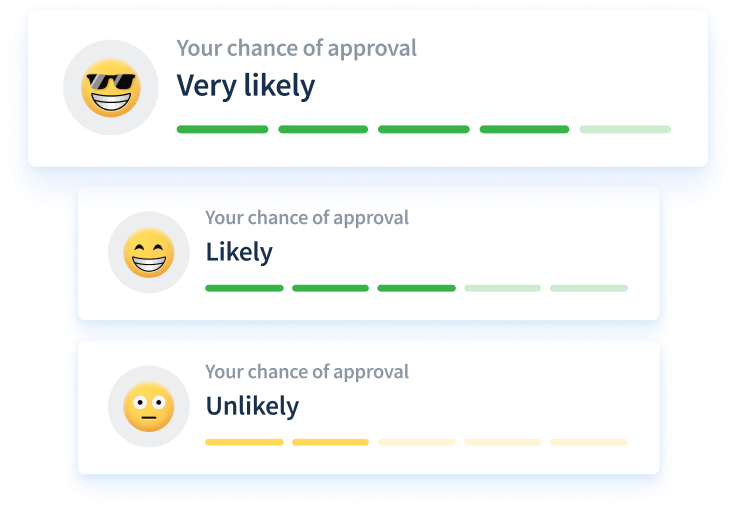

Use your score to find out if you can get approved for a personal loan or a credit card, with our feature.

Finder's chance of approval indicates your likelihood* of getting accepted for a credit product such as a loan or a credit card.

This can help you protect your credit score, by avoiding applications that you might not be eligible for.

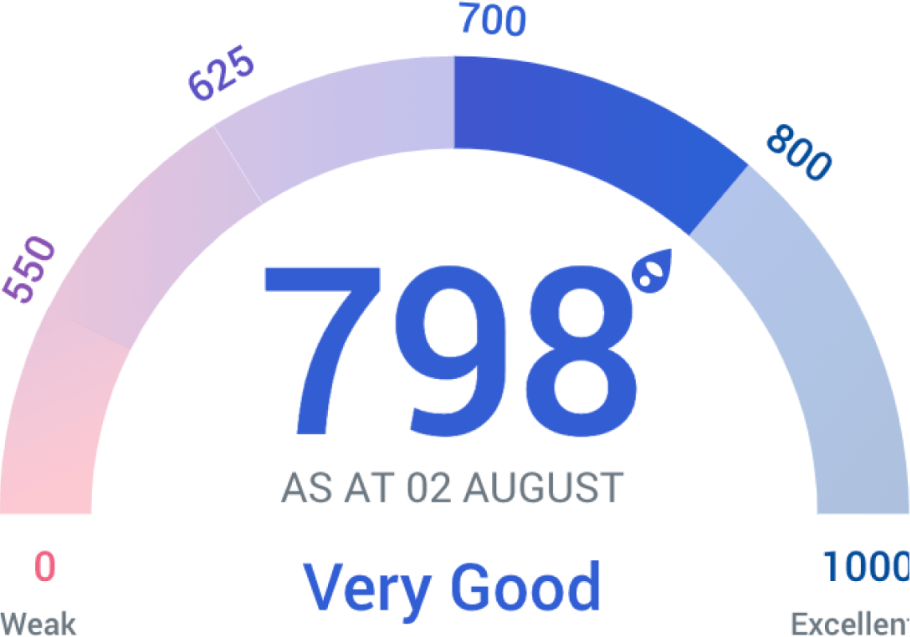

Your credit score is a numerical score that represents how creditworthy you are, or in other words, a number that demonstrates your reputation as a borrower. The higher the score, the more creditworthy you appear.

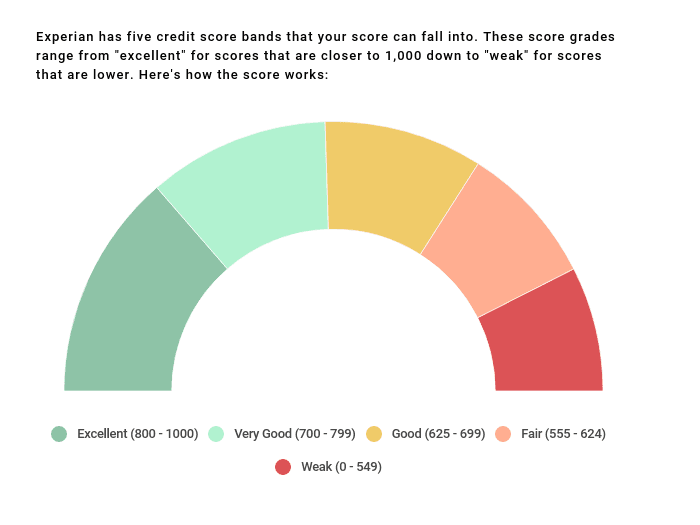

The higher the better when it comes to credit scores and based on the scoring system you'll receive through Finder, above 700 is a very good score and above 800 is considered excellent.

A credit report contains the nitty-gritty detail of how a credit score is calculated. Along with your date of birth, driver's license number and contact details, a credit report includes details of any credit product you've held or applied for., your repayment history, defaults on bills and loans and any bankruptcies or debt agreements.

A good credit score puts you in a strong financial position in several ways including giving you more negotiating power when applying for a loan, an increased borrowing capacity and a better chance of being approved for a loan or credit card.

As many times as you like! Your credit score will be updated once a month, or whenever something on your file changes (if you've opted into our credit file monitoring service).

If you find any errors on your credit report or see something that shouldn't be there, you should contact Experian immediately to request to have it removed. Learn more.

Finder's International Women's Day report explores the personal finance gap between men and women and the key drivers of financial inequality.

Get a firmer grasp of your finances with this free tool.

How to find out your credit score using this free tool.

Follow these tips to get a handle on your credit with this free tool.

How to get an accurate snapshot of your credit history with this free tool.

Find out what a credit score is and what it can do for you.

This guide explains credit score ranges from weak through to an excellent score. We cover the differences from Equifax, Experian and Illion.

Credit reporting bureaus issue credit reports and scores to consumers and lenders. Discover how they work in this guide.

It’s coming up to the busiest time of the year, when both our calendars and bank accounts are under the pump. And while Christmas festivities are a whole lot of fun, they’re also expensive. Here are some ways you can avoid your credit score being affected,

Placing a ban on your credit report can help to protect you from fraud. Here's how to request and extend bans with Experian, Equifax and ilion in Australia.