| 5.35 | % p.a. |

| 6.14 | % p.a. |

Apply for a loan up to $50,000 and repay your loan over 3 or 5 years terms.

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

| 5.35 | % p.a. |

| 6.14 | % p.a. |

| 6.39 | % p.a. |

| 6.39 | % p.a. |

| 4.99 | % p.a. |

| 4.99 | % p.a. |

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

A personal loan can give you access to extra money to pay for something bigger than your everyday purchases, it could be for a car, a wedding, a holiday, or even some home renovations.

No matter what you plan to take a personal loan out for, what you'll want to look for in a personal loan is the same. You'll want a loan that you can afford to pay back, with a competitive interest rate and over a time frame that allows you to make the payments without falling behind.

Personal Loan Finder® can help you find the right personal loan for you.

Latitude Group buys fintech personal lender Symple for $200 million. Latitude Group recently announced its acquisition of the fintech startup Symple. According to Latitude CEO Ahmed Fahour, the deal opens doors to a wider range of products and updated technology for customers. Symple offers fast loans up to $50,000. If you have a loan with either brand, nothing will change at this stage. Latitude Group could potentially launch a variable rate personal loan and faster applications and approvals in the coming future.

As lockdowns continue in parts of Australia, you may be finding it difficult to keep on top of your repayments. Most lenders have hardship measures in place to help you cope. You should contact your lender as soon as possible. It may be able to provide a solution. If you're looking for financial assistance, there are state-specific grants for businesses. There is also a government pandemic leave disaster payment. It offers support if you cannot earn income while you're self-isolating, quarantining or caring for someone.

RBA holds the cash rate. At its meeting on 3 August 2021, RBA held the cash rate at 0.10%. A low cash rate means that it is cheaper to borrow money. If you're in the market for a personal loan, it's unlikely this rate hold will affect your costs. With variable rate loans, if the hold continues into September, your repayments will neither increase nor decrease for that month. You will pay the same amount as you did the previous month. If you have a fixed rate personal loan, changes in the cash rate will not affect your repayments.

In a nutshell, a personal loan is a lump-sum payment or line of credit between $2,000 and $100,000 that you repay over a period of up to seven years.

Personal loans are used for a variety of things but generally people tend to take them out for those one off more expensive purchases like a car, paying for a wedding or doing renovations. However a personal loan can be useful if you need to consolidate existing debt you have elsewhere which can help you save on fees and multiple interest rates.

Like most loans, when you repay a personal loan you are charged interest on top of the loan, which is a percentage of the original amount (often called 'the principal' in bank speak) that you asked to borrow in the first place. The interest rate is set by the bank or institution that is doing the actual lending of the money to you.

Interest rates come in two forms, the standard interest rate (often called the advertised rate) and then there is what's called the comparison rate.

Jump ahead to one of the steps in the personal loan process to find out more about it.

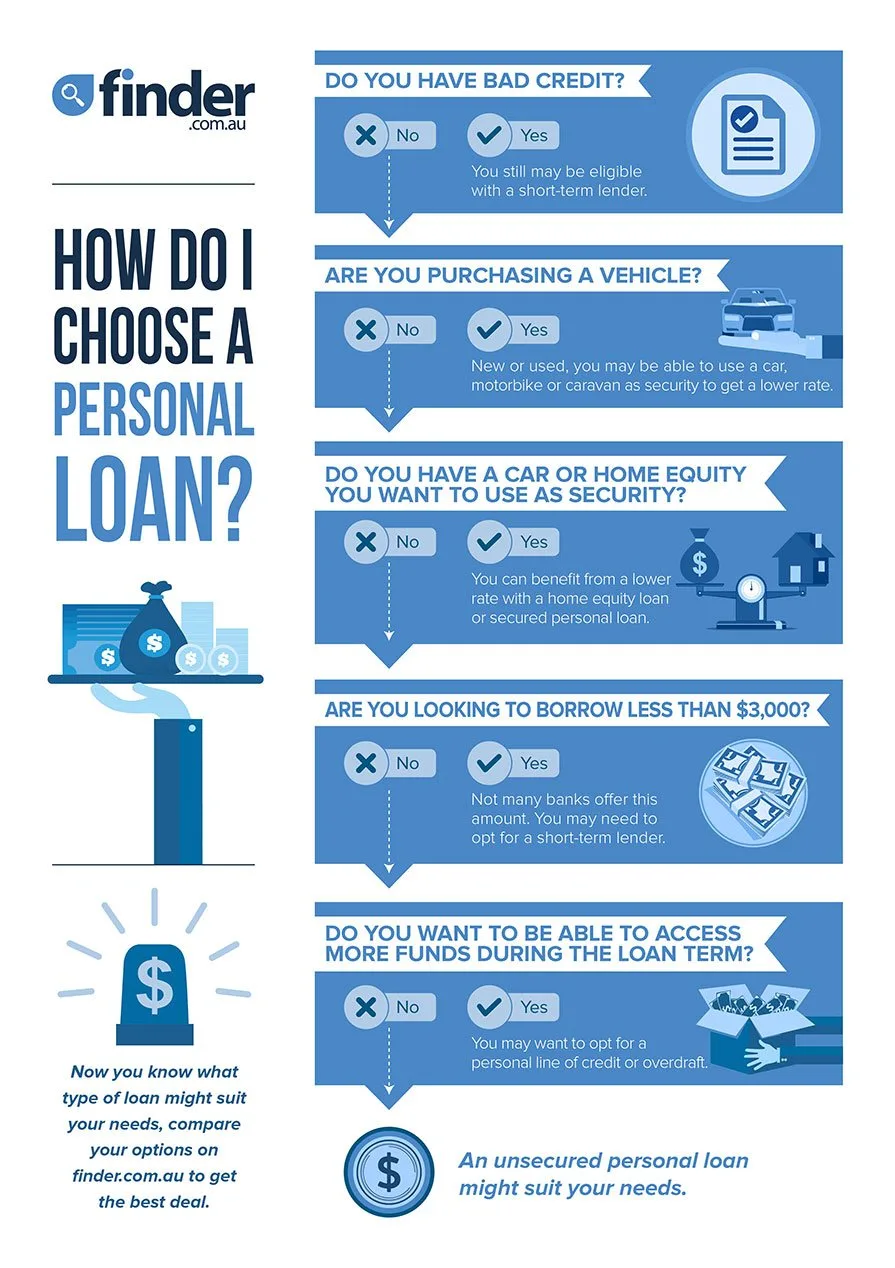

Finding the right personal loan is the first step of the process. There are a few parts to this, the first being choosing the type of personal loan that you want.

You can consider either a car loan or an unsecured personal loan. A car loan is preferable if the car you're looking to purchase is eligible to be used as security (not all used cars are) as the interest rates are lower. However, if you're buying a used car that is older, don't want to use the car as security for the loan or want to borrow extra funds for something else as well, you may want to consider an unsecured loan. You can compare both on the page above.

An unsecured loan is likely to be the best option. These can come as either a lump sum payment or a line of credit that you can draw on when you need to.

You won't have many options from banks for loans of this amount, so you may need to consider a personal overdraft, a line of credit or a credit card. You can also consider a short term loan (there is a comparison on the page above) these are very high-cost forms of credit and should only be taken out if you absolutely have no alternatives.

A secured personal loan can be a good option. This involves you attaching an asset you already own as security for the loan which means you'll be offered a better deal in terms of the interest rate. You can also use the loan for any purpose.

Debt consolidation loans work by letting you bring debts from different credit accounts together so you can pay them off with one rate and one set of fees.

When you're comparing loans for debt consolidation:

After you've decided which type of personal loan you want to apply for, here's how to compare the personal loan offers from different banks and lenders:

Lenders have set eligibility criteria for their personal loans. These can include any of the following:

However, even if you meet the minimum requirements for a loan, you will not be approved unless you can prove that you can afford the repayments. Lenders determine this by looking at your income, your debts and the stability of your employment.

The application process for a personal loan differs between lenders. Generally, you will have the option of applying online, in-branch (if the lender has branches) or over the phone. You can find a list of the documents and information required to complete the personal loan application on Finder's individual lender review pages or on the lender's website. You may be asked to provide any of the following:

Online applications usually take about 15 minutes to complete.

Some lenders can give you an answer instantly while others may take a few days or weeks to approve you. There are two forms of approval: full approval and conditional approval.

Conditional approval usually takes less time but is given pending more information from you. This includes information such as additional payslips or documents relating to your assets or debts. Lenders may also ask for this information and not offer any conditional approval. This is to help them make a more informed lending decision.

Full approval is given when you have supplied sufficient information for the lender to make a decision and the lender has approved you for the loan.

Your loan can be funded in a number of ways, depending on the type of loan it is and what you're using it for. For example, when you take out a car loan, the lender may pay the car seller directly. This is also often the case with a debt consolidation loan, as lenders may opt to direct funds to your debtors, rather than to you.

If the loan is an unsecured personal loan, the funds will be sent to an account that you nominate. Some lenders can transfer funds on the same day you apply, while others might take a few days following approval.

Most lenders will allow you to choose your repayment structure – either weekly, fortnightly or monthly repayments. Generally, the more often you repay your loan, the less interest you will pay over the life of the loan. Therefore, when choosing your repayment structure, you may want to consider additional and early repayments.

If you are making your repayments as set out in your loan contract, then your loan should be closed following your final repayment. However, if you are planning to repay your loan early, it's a good idea to call the lender and get a final payout figure if you're getting close to paying off your loan. This is to ensure that the loan will be closed when you make your final payment and you won't be charged any unexpected interest.

It might sound a bit obvious, but you do need to make sure that the personal loan you choose is the very best one that is going to suit your finances and your ability to pay the loan back. After all, you don't want to pay more money than you need, or worse impact your credit score by taking on a loan you cannot realistically pay back in the time allocated. To figure this out, we'll explain how personal loans work and what are the types of loans available so choosing one should be a snap.

While the interest rate is usually the magic number that grabs the headlines when looking at a loan, it's actually the comparison rate that is a much more useful number to look for, and it's one that will give you the best information about what you can expect to pay.

So what's so special about the comparison rate and how does it differ to the interest rate? The big difference is that the comparison rate includes all the other costs that come with the loan. It includes the interest rate plus any fees.

Imagine you are looking at an interest rate of 12.45% - this sounds good to you until you then take a look at the loan's comparison rate which is 14.52%. Why the difference? Because this particular loan comes with additional fees. On the other hand if you see a loan with an interest rate of 10.13% p.a and the comparison rate is also 10.13% then you'll know there are no extra fees and charges that will be added on top of the interest rate.

Comparison rates may be calculated differently depending on the loan. However, if they are provided, it needs to be disclosed how they are calculated. For example, it may be calculated on a personal loan of $30,000 over 5 years.

A comparison rate must be displayed alongside the interest rate by all lenders. If you're looking at the Finder comparison tables, you will be able to see a column labelled "comparison rate" for each loan. By scrolling over this rate you can see how it's calculated.

Quick tip: different loan amounts and loan terms can result in different comparison rates.

Absolutely! Interest rates are still an important part of your personal loan. For example, your outstanding balance will be charged interest calculated using the interest rate, not the comparison rate. It's vital that you know what the rate is and whether it's competitive. While comparison rates are there to give you a comprehensive overall idea of what you are in for financially with the loan. The interest rate is what you will be charged during your loan term (minus fees of course).

It's worth mentioning that the interest rate a lender advertises can be different from the interest rate you actually end up paying. During the application process lenders will factor in things like your credit score, the amount your borrowing, any existing debts you might have plus how much you earn when deciding your rate.

Read our guide to learn more about how your interest rate is determined

Banks and lenders that offer risk-based pricing determine your interest rate in a number of ways. They may consider the following:

Anna Serio is a trusted lending expert and certified Commercial Loan Officer who's published more than 1000 articles on Finder to help our readers strengthen their financial literacy.

"One of the biggest mistakes people make is assuming the lowest available rates are the rates they will get. In many cases, the lowest rates are only available on specific loan amounts and terms. That's why it's helpful to prequalify with a few lenders to get an idea of the kinds of rates and terms you're eligible for."

If you plan to take out a loan, you want to know you've taken out the best one available for you. So what should you look for?

Personal loans come with two types of interest rates: fixed or variable. Fixed interest rates on personal loans remain the same throughout the specified term, which may be for the entire loan term or for an introductory period. If you opt for a variable rate personal loan you will receive the advertised rate, but this rate may change throughout the loan term depending on interest rate movements in the market. So make sure you are comparing apples with apples across similar loans to make sure you're getting the best deal. If the loan is risk-based, you'll receive a rate based on your credit history and your general risk profile.

You'll need to consider both ongoing fees and the fees that are charged when your loan starts. Common fees include an application fee, exit fee or loan set-up fee, while monthly fees and annual fees are common ongoing fees. You might also be charged to use additional features of the loan so check out those too or ask the lender before you go ahead. A great idea is to keep an eye out to see if you're eligible for cost savings such as fee waivers that can help reduce the cost of the loan, every little bit counts.

How often are you able to make repayments? Are you able to make additional repayments or pay off the loan early without penalty? Is there a redraw facility if you do make early repayments? Some loans are inflexible in their terms and how repayments are made so if you need that flex - check it's possible with the loan you are interested in.

Personal loans are usually offered for terms of between one and seven years, with other loans on offer for shorter time periods. Some lenders are more restrictive than others when it comes to how long you have to repay your loan – for instance, only offering terms of one, three or five years. Make sure the loan terms on offer are what you need. Long term loans over seven years might offer lower repayments but you'll be paying a more interest over that period of time.

To get an estimate of your borrowing power, you can put your loan amounts into the personal loan calculator in the comparison tables above and you'll see what monthly repayments will approximately be.

Tip: This also can be a good time to see how the repayments will fit into your budget plus help you determine if you can afford to make extra repayments to pay off the debt faster.

Eligibility for personal loans depends on a few different things:

Each bank and institution have their own criteria that you will have to meet to finalise your loan application.

💵 Work out how much you need to borrow.

🔓 Choose a secured or unsecured loan.

📅 Decide between a fixed or variable rate.

📝 Choose your terms.

🔎 Start your personal loan research and comparison.

📱 Click through and apply.

There is no way to guarantee you're approved for a loan, but giving yourself the best chance at being approved starts with meeting the eligibility criteria set by the lender. Here are some top tips.

Read our guide on common loan rejection reasons and how to get around them

| Pros | Cons | Suitable for |

|---|---|---|

|

|

|

| Pros | Cons | Suitable for |

|---|---|---|

|

|

|

Still have questions? We've done our best to answer the most common questions people have when taking out a personal loan.

Different lenders can have your loan amount transferred to you within different amounts of time. Some banks are able to offer existing customers same-day personal loans, and some payday lenders can have loan amounts transferred to new customers within an hour of approval. If you are in need of cash as soon as possible it is advisable to check to see how long it will take to receive your loan amount before you apply.

The average interest rate depends largely on what type of loan you're applying for. If you get an unsecured loan the average interest rate is around 12-14% p.a. while a secured personal loan is between 8-12% p.a. If you opt for a peer-to-peer or risk-based lender the interest rate you receive will depend on your perceived risk.

The most important thing about getting an interest rate quote from a personal loan lender is ensuring your credit score will not be affected in the process. Most lenders offering interest rate quotes for personal loans call it something along the lines of a "Rate Estimate" or "Rate Quote" but will clearly state that it will not affect your score.

Secured loans, as the name suggests, means that you offer something of value as security on the loan. If you don't pay you may find the bank will repossess your car and sell it.

If you are having trouble repaying your loan you'll need to get in contact with your lender. They may be able to organise a payment plan with you, or be able to offer you some sort of option to help you manage your repayments. You also have the option of getting in touch with a free financial counsellor on 1800 007 007 to help you organise a budget.

If you are having trouble repaying your loan you'll need to get in contact with your lender. They may be able to organise a payment plan with you, or be able to offer you some sort of option to help you manage your repayments. You also have the option of getting in touch with a free financial counsellor on 1800 007 007 to help you organise a budget.

The answer to this question depends on what type of loan you are getting. If you are getting a secured car loan then all details of the car and finance agreement and registration must be given to the bank or lender before you receive the money. However, if you are getting an unsecured personal loan, then you only need to give a general idea of the loan purpose to the bank. If you are consolidating debts then you'll have to give details of your other loans and credits to the institution.

The answer to this question depends on what type of loan you are getting. If you are getting a secured car loan then all details of the car and finance agreement and registration must be given to the bank or lender before you receive the money. However, if you are getting an unsecured personal loan, then you only need to give a general idea of the loan purpose to the bank. If you are consolidating debts then you'll have to give details of your other loans and credits to the institution.

Credit unions are different to banks in that they operate in a not-for-profit business model. Typically you will find there are not as many fees or charges with a credit union loan which means the interest rate could be lower. Credit Unions are governed by the same regulations as banks so it's just as safe to apply for a credit union personal loan.

If you have a variable rate personal loan, then you may notice that your interest rate may go up or down. This could happen due to a range of factors but it mainly based on what the Reserve Bank of Australia dictates the official cash rate is. If you've found your rates have gone up, it may be a good time to consider refinancing your personal loan.

If you have bad credit and are worried that you may not get a loan from a bank or credit union, you may see ads for personal loans on Gumtree and want to apply. As with any form of finance you should always do your due diligence before applying. You should always check for an Australian Credit Licence and research the lender thoroughly. Alternatively, you could consider a no credit check personal loan lender.

Whilst a short term loan, also known as a payday loan is a type of personal loan, there are a range of differences that make this type of lending completely different. Personal loans are generally taken out over one to seven years, whereas a payday is between 16 days and one year. Payday loans are also for smaller amounts – between $100 and $5,000 – and are available to those with bad credit.

Personal loans can vary greatly in size from $1,000 and upwards of $80,000. If you're purchasing an asset such as a car keep in mind you may need funds to cover insurance. Many banks and lenders will consider up to $20,000 and $30,000 to be a medium sized loan. If you are only going to borrow between $10,000 and $20,000 then a small personal loan may suit your needs better.

Many lenders offer loan protection insurance as an add-on to your personal loan. This insurance can pay the minimum repayments on your personal loan if you lose your job, or cannot work because of illness or injury. You usually apply for the insurance when you are approved for the loan but you may be able to get the insurance further into the loan term.

Once you've actually successfully applied and received your funds, it's important to keep your loan up to date. If you've applied for a loan with the bank your everyday account is with, then you will probably have automatic direct debit setup. If your loan is with a separate institution then it is a good idea to set up an automatic transfer via internet banking a few days before your due date to allow for processing times. You'll be able to check your balance, interest rate, repayment dates and schedules. You should login to your loan account regularly to check notifications and payments details. If you want to make additional payments then you could do this by internet transfers, BPAY or if your bank allows it – over the counter deposits. If you miss a payment due to insufficient funds then it is important to call the bank and attempt to rectify the situation as soon as possible.

This a common concern for anyone applying for financial products that have an application fee. Before you apply you should confirm this in the PDS, but as a general rule, the fee will be charged only when you are approved for the loan and is often debited from your loan account. To be sure, check the product disclosure statement (PDS) for the loan.

Yes, personal loans can help with your business needs too. You can access personal financing to help cover business needs — everything from trucks to equipment can be purchased or even leased with a personal loan. The same is true even if you have bad credit. Business vehicles including company cars, trucks or vans can all be financed with a personal loan. If your business requires specific equipment to purchase or lease, such as forklifts, earthmoving equipment, workshop machinery, or even office equipment, you can take out a personal loan to help cover the costs. You won't have to hurt your business' cash flow to make the purchase.

Kate Browne is Finder's managing editor for Australia. She worked as an investigative journalist and lifestyle editor at CHOICE and has written for publications including the Sydney Morning Herald, Sun Herald, The Age, news.com.au, Sunday Telegraph, The Australian, The Big Issue, Sunday Life, Kidspot and Essential Baby. She co-authored the best-selling non-fiction book The Checkout in 2016. You might also recognise her as one of the writers and presenters of ABC TV's top-rating consumer affairs show The Checkout, which ran from 2013 to 2018. She is a media spokesperson for Finder and regularly appears on Nine, Seven and on the radio. Kate has a Bachelor of Arts in Communication from the University of Technology Sydney.

Are you an existing Commbank home loan customer looking to make your home more energy-efficient? Apply for a 0.99% p.a. Commbank Green Loan for up to $20,000. No fees attached.

If you don't quite meet the criteria for a personal loan, applying with a guarantor can help get your application over the line.

A Green Loan from Handypay could help you make your home more energy-efficient. Handypay green loans are available up to $75,000 on terms of up to 10 years.

With a Variable Rate Personal Loan from Great Southern Bank you get simplicity matched with the opportunity to save yourself hundreds of dollars in interest fees. The flexibility in repayments that this loan gives you makes it easy to keep up with and pay it off without incurring extra fees.

When you have a large expense that your savings can’t cover, a personal loan at a fixed rate from Great Southern Bank is an option worth considering. With no fees and a competitive fixed interest rate, this could be the right loan for you.

Pepper Money is an Aussie non-bank lender that offers a vast range of personal loans and home loans to customers Australia-wide. Find out more here.

Find out more about Handypay's personal loans for home improvements. Personalised rates start from 6.75% p.a. on terms from 1 to 7 years.

Find out more about Pepper Money's no fee personal loan and benefit from a competitive rate from 6.95% p.a., zero fees and loan terms of up to 7 years.

Looking to renovate your home? Find out more about Brighte's personal loan for home improvements and ways in which it may be able to benefit you.

Get rewarded for an excellent credit score with a NOW Finance personalised rate secured personal loan. Rates vary between 4.45% p.a. and 15.45% p.a. Apply today.

You'll receive a fixed rate between 5.35% p.a. and based on your risk profile.

Apply for a loan up to $50,000 and repay your loan over 3 or 5 years terms.

You'll receive a fixed rate of 8.99% p.a.

Apply for up to $50,000 to use for a variety of purposes without needing to add security. Available to self-employed applicants.

You'll receive a fixed rate between 6.99% p.a. and 18.99% p.a. ( 7.91% p.a. to 19.83% p.a. comparison rate) based on your risk profile

Borrow from $5,000 to $55,000, with 1 years to 7 years loan terms available. This loan comes with no fees for extra repayments and no early exit fees.

You'll receive a fixed rate between 5.95% p.a. and 19.99% p.a. based on your risk profile

A loan from $5,000 to use for a range of purposes. Benefit from no ongoing fees and no early repayment fee.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

finder.com.au is one of Australia's leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines.

finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service.

Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan.

Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money here.

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

I am currently in the divorce process and about to start the parenting order and property settlement on court. However, my wife controlled all our property including money, car, house and businesses, and she made up a story to successfully applied an interventional order against me, kicked me out of home and refused to provide anything even just for basic living requirements.

The total assets need settlement worth about $2 million dollars, my lawyer Mr Byron Leong from Lander & Rogers Lawyers estimated that my legal cost would be around $40k, Mr Leong was also very confident that in the least favorable scenario I will get 30%, which is about $600k in the settlement. However, I was prevented to access any funding by my wife, and therefore I wanted to apply for a loan to cover my legal cost and living expenses during the legal process, roughly $50k, which is way less than the amount that I can get from the property settlement.

In order to make my application competitive, my lawyer can provide his professional opinion on my case, his senior background and the firm’s outstanding reputation is persuasive, along with my agreement to repay the loan before I can get any money after the settlement. Moreover, my first concern is the custody of my daughter rather than property, therefore I can accept relatively high interest and any other reasonable cost, any of your help will be very appreciated.

Hi Guo,

Thanks for getting touch! I’m sorry to hear about your situation. I understand that you are in a difficult place right now. It’s helpful to know that Finder doesn’t make assessments and only the providers on the page (when contacted) can proceed with your application. Please see above the available providers listed. As a friendly reminder, review the eligibility criteria of the loan before applying to increase your chances of approval. Read up on the terms and conditions and product disclosure statement and contact the bank should you need any clarifications about the policy.

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

Best,

Nikki

My husband and I are in our late 50’s we want to borrow $30k to consolidate some loans and to get some work done to our car and house. Do you think our age will prevent us from getting a loan? We don’t intend to retire for another 5 years.

Hi Shelley,

Thank you for reaching out to finder.

There is no maximum age for taking out a personal loan. But you may want to consider how to improve your chances of the loan being approved.

Establish your borrowing capacity. What repayments can you afford? Lenders will use a variety of criteria to decide how much you’re eligible to borrow, but you need to know how much you can afford to repay.

Building a good banking history. Keep your account in good standing to build a positive relationship with your bank, even if you don’t plan on borrowing from them.

Keep your credit rating in good standing. Make sure you keep track of all your payments, from credit cards to utility bills, because any arrears, debts, or missed payments will affect your ability to access credit.

Keep track of your saving goals. If you manage to contribute to your savings regularly, it shows lenders that you are likely to manage ongoing loan repayments.

Hope this helps!

Cheers,

Reggie

Help me get cash fast??

Hi Elika,

Thank you for leaving a question.

I understand your situation in needing cash fast. You are on the correct page to make a selection on where you could apply for a personal loan. Kindly review and compare your options on the table displaying the available providers. Once you have chosen a particular provider, you may then click on the “Go to site” button and you will be redirected to the provider’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. Hope this helps!

Cheers,

Reggie

If I apply for a personal loan and it is declined does this affect my credit rating?

Hi Martin,

Thank you for getting in touch with Finder.

Declined application will not affect your credit rating. However, every time you make an application for credit it’s listed on your credit file as a “credit enquiry”. It will be listed regardless of whether the application is approved or not.

You can learn more about credit enquiries. On the page, you’d learn how long do credit enquiries remain on your credit file, how do credit enquiries look like on your credit report and other related pages on credit file/report.

I hope this helps.

Please feel free to reach out to us if you have any other enquiries.

Thank you and have a wonderful day!

Cheers,

Jeni

please a friend of mine introduced me to this lender jacksonbenloanfirm@outlook .com and i tried them and got a loan of 45,000$ but i still need more for a project am working on i don’t know if it right to ask them for more?

Hi Marie,

Thanks for leaving a question on our page.

Please know that we’re a product comparison website and we don’t stand as a representation to any individual or any company featured on our site.

You can browse through the personal loan options we have above.

If you need to increase your loan amount, all you need to do is ask them to give you an increase in your loan amount. Goodluck!

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

Cheers,

Nikki