{"menuItems":[{"label":"What does \"interest-free days\" mean?","anchorName":"#mark1"},{"label":"Answers to the most common questions about interest-free days","anchorName":"#mark2"},{"label":"Compare 55 days interest-free credit cards","anchorName":"#mark3"},{"label":"What else do I need to know when using a credit card with interest-free days?","anchorName":"#mark5"},{"label":"Diagram: How do interest-free days work?","anchorName":"#diagram-how-do-interest-free-days-work"},{"label":"More questions about credit card interest-free periods","anchorName":"#more-questions-about-credit-card-interest-free-periods"}]}

Most credit cards offer you interest-free days for new purchases, giving you a way to borrow money for "up to" a set number of days without having to pay interest. To take advantage of the interest-free period, you usually have to pay your previous credit card balance in full by the due date on your statement.

But credit card companies profit from interest, so why would they offer this feature? Most people don't take full advantage of their interest-free days or carry a balance from month to month. Here's what you need to know to save yourself the most money.

What does "interest-free days" mean?

Interest-free days give you a period of time when you can make purchases without being charged interest during your credit card billing cycle. Interest-free days begin on the first day of your statement period and end on the payment due date. For example, if you made a purchase on day 1 of a statement period, you could have 55 days to pay it off before interest is applied to the balance. A purchase made on the second day of that statement period would give you 54 days interest-free, and a purchase made on day 30 would give you 25 days to pay it off before interest is charged.

Other key definitions you need to know

When you're learning about interest-free days, you'll often come across a number of other terms that relate to this feature. Here are three major ones to take note of:

- Statement period/billing cycle. The statement period usually runs for 30 days, or from when your last statement was issued to when the next one is issued. With interest-free days, this is the time when you can make purchases and avoid interest.

- Statement issue date. This is the date on which the bank issues your monthly credit card statement.

- Payment due date. The date by which you must pay the balance to avoid late charges/fees. If you want to get interest-free days, you'll usually have to pay your full balance by this date.

- Purchase rate. The interest rate charged on purchases. Interest-free days help you avoid this cost.

Answers to the most common questions about interest-free days

How do I receive interest-free days?

To be eligible to receive interest-free days, you must repay your account's outstanding balance in full by the due date on your statement. Usually, you'll need to pay the full balance for the statement that you got before the start of that billing cycle, as well as the statement issued at the end of it.

Why does it always say "up to 55 days"?

The amount of interest-free days available varies depending on what day of your billing cycle you make the purchase. While you would get 55 days interest-free on purchases made on the first day of the billing cycle, you'd get 54 on the second day and only 1 day interest-free if you made a purchase the day before your statement was issued for that billing period. So "up to" is used to refer to the maximum amount of days you can get interest-free in your billing period.

Can I make interest-free purchases with a balance transfer credit card?

If you want to pay off existing debt with a 0% balance transfer offer, be aware that it could affect the interest-free period for new purchases. Some credit cards only offer interest-free days for purchases when you pay the account's entire closing balance, including any balance transfer debt. Others let you make interest-free purchases when you have a balance transfer, as long as you pay the entire purchase balance for your statement – and may even list that balance on your statement. For example, NAB has an "interest-free days payment" amount that you can pay to still get interest-free days while you carry a balance transfer debt, while Westpac has a "Monthly Payment Balance" that shows the amount you need to pay to get interest-free days on purchases.

Is a credit card with interest-free days suitable for me?

If you pay off your credit card balance in full by the due date each month, a card with interest-free days will allow you to make purchases without paying interest. This could be ideal if you use a credit card to earn rewards or for short-term cash flow such as spending between monthly paydays. You could also use it as an alternative to other buy now, pay later services. But if you think you might not be able to pay the account’s closing balance in full each month, you may like to consider low interest rate credit cards and 0% purchase offer credit cards.

Compare 55 days interest-free credit cards

What else do I need to know when using a credit card with interest-free days?

You can use a credit card with interest-free days to save on your account costs when you meet specific requirements. Here are the key details to keep in mind so you can make use of your interest-free days:

- Minimum monthly payments. You usually can't get interest-free days for purchases if you only pay the minimum amount required on your statement, as most credit cards only offer this benefit when you pay your balance in full by the due date.

- Eligible purchases. Interest-free days are only available for "eligible purchases" made on your card. While this usually includes everyday spending at the supermarket, petrol station, restaurants and so on, exclusions typically apply for cash advance transactions, government payments and some bill payments. Check with your credit card provider for details on what is considered an "eligible purchase" for your card.

- Dates vary. Don’t expect all your credit cards to come with similar billing cycle dates and dues dates. These dates can vary from one card to the next, even when issued by the same card issuer.

- Instalment plans. If you set up an instalment plan for part of your credit card balance, you will usually have to pay the required instalment repayment, as well as the rest of your monthly account balance, to remain eligible for interest-free days. These details will usually be shown on your credit card statement, as well as your provider's website. If you're unsure, contact your provider to check whether you can still get interest-free days when you have an instalment plan.

Example: Making use of interest-free days

Let’s assume you have a credit card that offers 55 interest-free days and its billing cycle begins on the 1st of each month and ends on the 30th. Given the 55 interest-free days, the due date on your credit card statement would be the 25th of next month. So if you were making purchases in June, here's how it would look:

- 1st June. First day of the statement

- 30th June. Last day of the statement

- 25th July. Due date of your payment for June

In this case, the 55 interest-free days begin on 1st June and end on the 25th of July when your payment is due. So here's how your interest-free period would work as you make purchases throughout the month:

- You make a $200 purchase on 1st June. You don’t have to pay any interest towards this purchase until 25th July, which gives you 55 interest-free days.

- You make a $100 purchase on 20th June. This is the 20th day of your billing cycle, so you don’t have to pay any interest towards the purchase until 25th July. This means you get 35 interest-free days.

- You make a $150 purchase on 30th June. This is the last day of your billing cycle but the purchase won't attract any interest until 25th July, giving you an interest-free period of 25 days.

When you're statement is issued for June, you'll owe $450. So as long as you pay this in full by the 25th July, you won't be charged interest on your purchases and can continue to enjoy interest-free days for the next billing cycle.

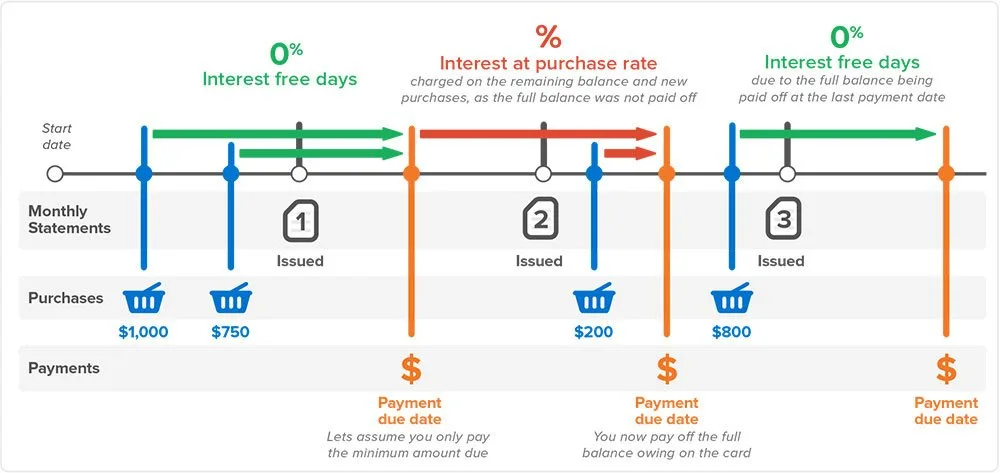

Diagram: How do interest-free days work?

Interest-free days can be tricky to visualise, so you can see this handy diagram to understand how it works. As well as showing the interest-free period (in green), we also show when purchases are made, when the statement is issued and what happens if you pay less than the full amount for a billing cycle (the middle one in this case).

Credit cards that come with 55 interest-free days give you the ability to make purchases and not pay any interest towards them as long as you make timely repayments. Such cards can come with a number of other features as well, so it’s important that you choose a card as per your requirement. Bear in mind that just about every credit card issuer provides cards with interest-free days on purchases, so it is in your most interest to compare as many as possible before making a decision.

More questions about credit card interest-free periods

What is the maximum number of interest-free days I can get?

With Australian credit cards that offer interest-free days, the maximum interest-free days you can take advantage of usually vary in between 44 and 55, depending on the card you use. In the past, some cards have offered up to 62 days interest-free and others have extended interest-free finance options with specific retail partners.

Do additional cards also get interest-free days?

Additional cards linked to your primary card follow the same billing cycle as the primary card and offer just as many interest-free days on purchases.

I can’t pay my account’s closing balance in full this month, but I can in the future. Will I ever get interest-free days again?

Once you start paying your account’s closing balance in full each month again, you can start making use of interest-free days on purchases.

Back to top

Is paying telstra, synergy, Alinta gas , western power also a cash advance or can I use my credit card

Hi Nicole,

Thanks for your inquiry.

If these falls under bill payments then typically they may be considered as cash advances. I suggest that you speak to your credit card provider directly to confirm whether the payments for the mentioned services or utility providers are considered as cash advances. You can also revisit your cardholder agreement with your credit card provider to learn more about their terms.

To know more which credit card transactions fall on cash advances, kindly refer to our guide on cash advances.

I hope this helps.

Cheers,

Debbie

Hi,

If my statement closes on say the 30th October and I owe $100 on my credit card which is due 15th November, if I pay the $100 off on the 10th November and then proceed to spend another $50 on my credit card that same day, is my balance considered cleared on the 15th November and that $50 goes to next months billing cycle or will I be charged interest on that new $50 now?

Hi Hayley, thanks for your inquiry!

To allow us to assist you further could you provide us with a specific bank please?

Cheers,

Jonathan

Hi Jonathan,

ANZ – Platinum rewards

Hi Hayley, thanks for your response.

Even if you had cleared your $100 outstanding balance, your entire balance (including the $50) would have to be cleared before your payment due date in order to receive interest-free days on your purchases.

I hope this helps.

Cheers,

Jonathan

Hi

Iv just got a mortgage and want to utilize a credit card with my monthly day to day spending so I can pay my weekly income straight off the mortgage. I then want to redraw from my mortgage to pay off my credit card each month.

Can I get a card which will allow me to make both purchases and cash withdrawals which will be interest free over a 1 month period?

Hi Ben,

Thanks for your inquiry.

Please refer to the following link for a list of 0% purchase cards. As of this time, there are no interest-free rates on cash advances, although there are low rate cash advance cards available.

You can press the “Go to Site” button of your preferred credit card to proceed with your application. You can also contact the provider if you have specific questions. A gentle reminder, please ensure to read through the relevant product disclosure statement and terms and conditions to ensure that you got everything covered before you apply.

Cheers,

Jonathan

My question is:

If I paid in full one period, it supposes I am not going to be charged with interest for that period (which is reflected in my next statement). My bank charged me interest anyway the next period. I asked the bank and they replied that only if I pay in full every period I am not getting charged with interest.

Is that correct?

Thanks…

Maria

Hi Maria,

Thanks for your question.

This is correct. Only by paying your balance in full each month are you able to avoid interest on purchases each statement period.

Hope this has helped.

Thanks,

Elizabeth

If I do an EFT with my credit card do I benefit the up to 55 days interest free credit if I pay back the balance in full

Hi Stellah,

Thanks for your question.

Yes as long as you’re using the EFT for a purchase (not a cash advance) and pay your balance in full within the statement period, the interest free days apply.

Cheers,

Shirley