Westpac Personal Loans

Looking for a personal or car loan? Or a short-term overdraft? Interest rates depend on the product you choose and fees apply.

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

- COVID-19 Update

If you're struggling to repay your personal loan, you can get in touch with the bank directly or read our guide.

Westpac offers a range of personal loans for a variety of purposes. You can opt for a unsecured personal loan with interest rates starting from 8.99% p.a., or use their flexi loan like a line of credit. Interest rates for their flexi loans are higher, starting from 16.49% p.a. They both come with a limit of $50,000 and include an establishment fee of $150 to $250 and a monthly service fee of $12. The credit limit for their car loan is 12.09% p.a., and it is secured with the purchase of your car. The establishment fee is $250 and the monthly fee is $12. You could also get a short-term overdraft for up to 45 days, with interest rates starting from 12.09% p.a. The establishment fee will depend on how much you borrow and ranges from $12 to $100.

Westpac loan product rates

- Personal loan. The Westpac unsecured personal loan has a 8.99% p.a. interest rate and 10.17% p.a. comparison rate.

- Car loan. The Westpac car loan has a 6.49% p.a. interest rate and 7.69% p.a. comparison rate.

Compare the Westpac products below

Westpac began trading in 1817 in New South Wales and has since grown into a public company that has branches around the world. Westpac offers a wide variety of financial products and services to its customers, from savings accounts and term deposits to credit cards and home loans. It also offers a range of personal loans to borrowers, giving them access to the finance they need to make important purchases and investments.

- Flexi Loan. This loan allows you to withdraw funds up to an agreed-upon limit without reapplying, working like a line of credit rather than a traditional personal loan. This is an option for borrowers looking for flexibility. The Flexi Loan has a credit limit of between $4,000 and $50,000 so it is useful for a variety of purposes. Westpac charges no fee for additional withdrawals and there is no early repayment fee.

- Personal Loan. This is designed for individuals who want to have a fixed interest rate loan. It is an unsecured loan that can be used for a variety of reasons such as home renovations, education expenses or a car purchase. Terms of between 1 year and 7 years are available, and you can apply for between $4,000 and $50,000. It's also possible to repay your loan faster, but if you have loan terms of longer than two years and pay back the loan within those two years, a $175 fee applies. This fee is waived if you refinance to another personal loan from Westpac.

- Car Loan. Looking to buy a new or used car? This loan features fixed interest rates and repayment terms of between 1 year and 7 years. You can borrow between $10,000 and $100,000 to buy a car which will be used as the security for the loan. Keep in mind there's a set-up fee of $250 and a monthly service fee of $12.

Features and benefits of a Westpac personal loan

- Flexible repayment terms. You have the choice of paying weekly, fortnightly or monthly to suit your budget.

- Revolving credit. This Flexi Loan feature essentially acts as an overdraft, allowing you to borrow up to the and including credit limit.

- Competitive rates. Westpac's personal loan products feature competitive rates to help customers save money on interest.

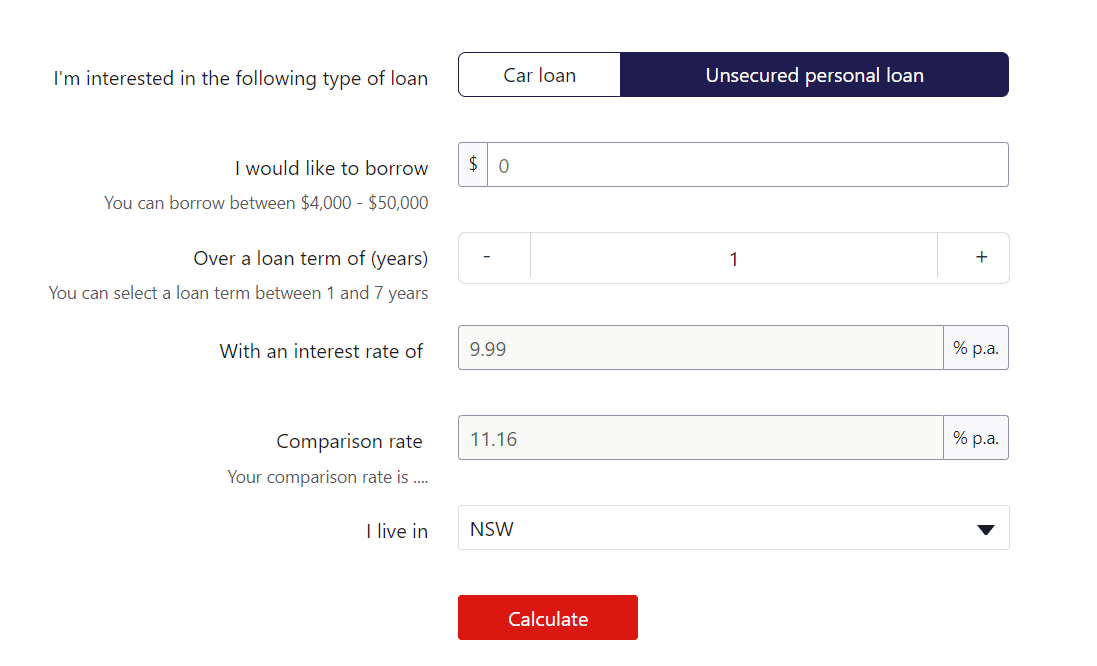

Westpac personal loan repayment calculator: How much will a Westpac personal loan cost?

Westpac offers a personal loan calculator on its website to help you determine the cost of using its personal loan. You start by selecting whether you want to calculate the costs of a car loan or an unsecured personal loan, and then you input the following information:

- How much you want to borrow

- Your preferred loan term

- The interest rate and comparison rate of Westpac's personal loan will be entered for you

- Select the state you live in

After you enter the required information you will be shown the estimated repayments for your loan. You can select weekly, fortnightly or monthly repayments. The loan amount, estimated interest cost and estimated total cost of your loan will be displayed. To adjust these, simply scroll back up and select a different loan amount or terms.

You can also use a personal loan calculator to get an estimate of your loan repayments.

Loan Repayment Calculator

What other products does Westpac offer?

- Bank accounts. Westpac offers a comprehensive range of bank accounts which includes transaction accounts, savings accounts and term deposits.

- Credit cards. Whether you want a low rate credit card, a low annual fee credit card or a rewards card, Westpac has cards to suit a range of customers.

- Home loans. The bank has loans for first-time homeowners, investors and people who want to move up the property ladder. You are able to choose from fixed rate, variable rate or combination loans.

How you can apply for a personal loan from Westpac

Applying for a personal loan from Westpac is a straightforward process, and you can get started by clicking "Go to Site" on any of the loans above. The eligibility criteria is as follows:

- Be over the age of 18

- Have a regular, permanent income

- Be a permanent resident of Australia or;

- Hold an acceptable Visa and have confirmed employment in Australia

If you meet the above criteria, the following details will be required to complete your application:

- Personal details such as your name, proof of your identity and your contact information

- Details about your finances and your employment

- A list of your assets and liabilities, if you're self-employed

You need to meet set eligibility requirements which include being a permanent Australian resident, being at least 18 years old and earning a regular income. Some of the documents that should be included with your application are details of your finances, contact details including your residential address, and proof of identity. If you are a Westpac customer, the bank will ask you to verify your records.

If you would like to apply online you can follow the secure link on this page and fill out an application form in as little as 10 minutes. Westpac also accepts applications over the phone or through their branches.

These Westpac loans are worthwhile options for prospective borrowers to consider, but make sure to compare your options before deciding on one particular loan.

More guides on Finder

-

Westpac Flexi First Option Home Loan

The Westpac Flexi First Option Home Loan is a basic home loan with a competitive variable rate and no loan maintenance or extra repayment fees.

-

Westpac Fixed Rate Investment Property Loan

You can benefit from certainty over an extended period of time when you choose the Westpac Fixed Rate Investment Property Loan. Lock in to a low rate now and take advantage of their flexible repayment options.

-

Westpac Rocket Repay Home Loan

With a 100% mortgage offset account like the Westpac Rocket Repay home loan, you can own your home sooner.

-

Westpac Fixed Options Home Loan Review

Lock in and secure your interest rates with Westpac Fixed Options Home Loan. Compare the rates and product details of the loans.

-

Westpac Variable Rate Premier Advantage Package

The Westpac Premier Advantage Package offers discounts and waived fees in exchange for bundling your financial products together.

Personal Loan Offers

Important Information*Ask an Expert

Hi.

I’m on a pension and have just finished paying out a high interest loan and have one default which was only $100 and was paid out as soon as I realised that I had it there. Now I’m finding it hard to get a loan of $10,000 over 4 years with the repayments less then what I have been paying for the last two years so I’m at a lost why I can’t get a loan as I’m getting $1,335 p/f do you know why I’m having trouble getting finance. Thanking you in advance

Hi Wayne,

Thank you for visiting Finder.

First, check your current credit score as it is one of the eligibility requirements that most lenders look into when they are making their decision in regards to your loan application. You may also request for your credit report to see if there are any wrong listings regarding your credit history or if you have any other default payments that you are not aware of.

In case that you have a poor credit score, it may be difficult to get approved for a personal loan. In most cases, lenders require good to excellent credit but do not lose hope. There are quite a few that will accept applications from people with bad credit, however, this can cost higher interest rates and poorer terms. Please refer to our list of bad credit personal loans to compare your options. Kindly take note that the lender’s approval will still depend on their assessment of your financial situation.

Lastly, you may use our personal loan calculator to know if the loan that you are applying for is the right one for you when it comes to repayments.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

I hope this helps.

Let us know if there is anything else that we may assist you with.

Cheers,

Ash

Hello.is it possible to get loan if i have 1 year working holiday visa?i came to Australia in 11th of January 2018 but i haven’t worked here yet.if its possible then what kind of amount of money i could get

Hi Andrei, thanks for your inquiry.

Can you confirm the code of your working holiday visa, so we can assist you further please?

Best,

Jonathan

I wish to apply for a $100,000 loan.

Hi Jerome,

Thanks for your inquiry.

If you are referring to Westpac’s personal loans, you may select your preferred loan to see more details, then you may select the ‘Go to site’ button to submit an online application through Westpac’s official site.

You can also have a look and compare your options on our $1000 loans page.

Cheers,

Rench

Hi, I’m working for a big company as a sub-contractor driver and I receive my salary based on one year agreement and by payslip under my ABN number. My question is, is it enough to bring my last payslips or I must provide my last tax return history?

Thanks

Hi Adam,

Thanks for your question.

When applying for any type of credit, it’s best that you are ready to provide any proof of your income (e.g. tax return, pay slips, COE, etc.), finances and employment. These documents are generally required by most lenders. So if you could provide the most recent ones, that would be great.

Hope this has helped.

Cheers,

May

So after read all this, me and my husband are on Centrelink payments at the moment, but we both do save about $150 every week to help us to move.

My husband receives FTB and Newstart for more than 5 years+ and I’m receiving Parenting payment Partnered.

Can we get approved to apply Westpac credit card? Or which bank will approve?

Hi Jane,

Thanks for your question.

Westpac handles credit card applications from Centrelink applications on a case-by-case basis. Your eligibility will depend on your financial situation, how much you receive in payments and what other debts and assets you have. You may want to give Westpac a call to discuss your eligibility.

I hope this has helped.

Thanks,

Elizabeth

My question to Westpac personal lending is why you present misleading information on a site like this where pensioners already feel disqualified from applying for credit. I did my homework as the site suggested. I get the full DSP pension and was told before applying for a loan what I could potentially borrow. After my loan was declined due to sustainability, I made further inquiries and no one would give me a firm answer until I eventually saw a Westpac bank manager who clearly said that a DSP is not enough income to sustain a loan not even for $4000. It says on this website though that you only need 15K per annum to apply for credit. You actually need double that amount. This experience left me with a bad taste in my mouth and I have been with Westpac for over 26 years with a good credit rating and no defaults on my Veda credit file. Can someone from Westpac please be honest and advice what your total income must be before the bank will even look at you!! Also I found really strange that I was not asked about my cash assets or any other asset for that matter to support my application

Hi Gavin,

Thanks for your question and sorry about the difficulty you’ve had. On our review pages, including the one above, we haven’t listed $15,000 p.a. on any criteria. Westpac also doesn’t list a minimum income criteria on its site.

The minimum criteria is that you’re over the age of 18 and earn a regular income, and we’ve confirmed with Westpac that certain types of Centrelink payments can be considered as income. However, your eligibility still comes down to whether or not you can afford the loan – Westpac will look at your income, your current debts and any cards you hold, and as an existing customer, your bank statements will also be checked to confirm your details.

If you have questions regarding your specific application or eligibility for the loan, it would be best to contact Westpac directly.

Thanks,

Elizabeth