Citi Personal Loan Plus

variable rate

comparison rate

variable rate

comparison rate

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

An unsecured personal loan lets you borrow money without using an asset as security. They can have shorter applications and faster approval times than secured loans. However, unsecured personal loans are more expensive than secured loans.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

An unsecured personal loan is money you borrow from a bank or a lender to pay for a big expense.

It is called "unsecured" as you don't need to provide a personal asset (like your house or car) as security for the loan. Because the lender does not have an asset as security, their risk is higher. As a result, these loans have higher interest rates.

These loans can be for amounts as small as $1,000 or for larger amounts up to $100,000. You can pay the loan off over a period of time that you set.

You can take an unsecured personal loan to pay for your wedding, home renovations, dream holiday, a new car or cosmetic surgery, for example. It can also be used to pay off your existing debt or consolidate other, higher interest debts.

Unsecured personal loans can be used for single or multiple purposes, unlike secured loans.

A comparison rate helps you understand the true cost of a loan. Displayed as a percentage, this rate includes both the interest rate and the various fees and charges that come with the loan. That's why it is generally higher than the displayed interest rate. Please read our guide to personal loan comparison rates for more information.

Are you wondering how unsecured personal loans compare against secured personal loans? We've highlighted the pros and cons of unsecured personal loans below.

Pros

With secured personal loans, you can only use the money for a specific purpose, such as purchasing a car.

You can use an unsecured personal loan for a single expense, such as a large medical bill. Or you could use it to pay for various expenses, such as renovating your home and buying new furniture or appliances.

Cons

This is because the lender does not have an asset as security, making the loan more risky. To protect against this, the interest rate is higher.

There are a multitude of options for what you can use your unsecured personal loan for:

Interest rates on unsecured loans are higher for borrowers, as lenders are taking on a higher risk. If your loan is secured, the lender can take ownership of the asset you've used as collateral to cover the cost of the loan. Because they don't have that collateral on an unsecured loan, to safeguard themselves, lenders charge more interest so that they have more to fall back on should you fail to meet your repayments.

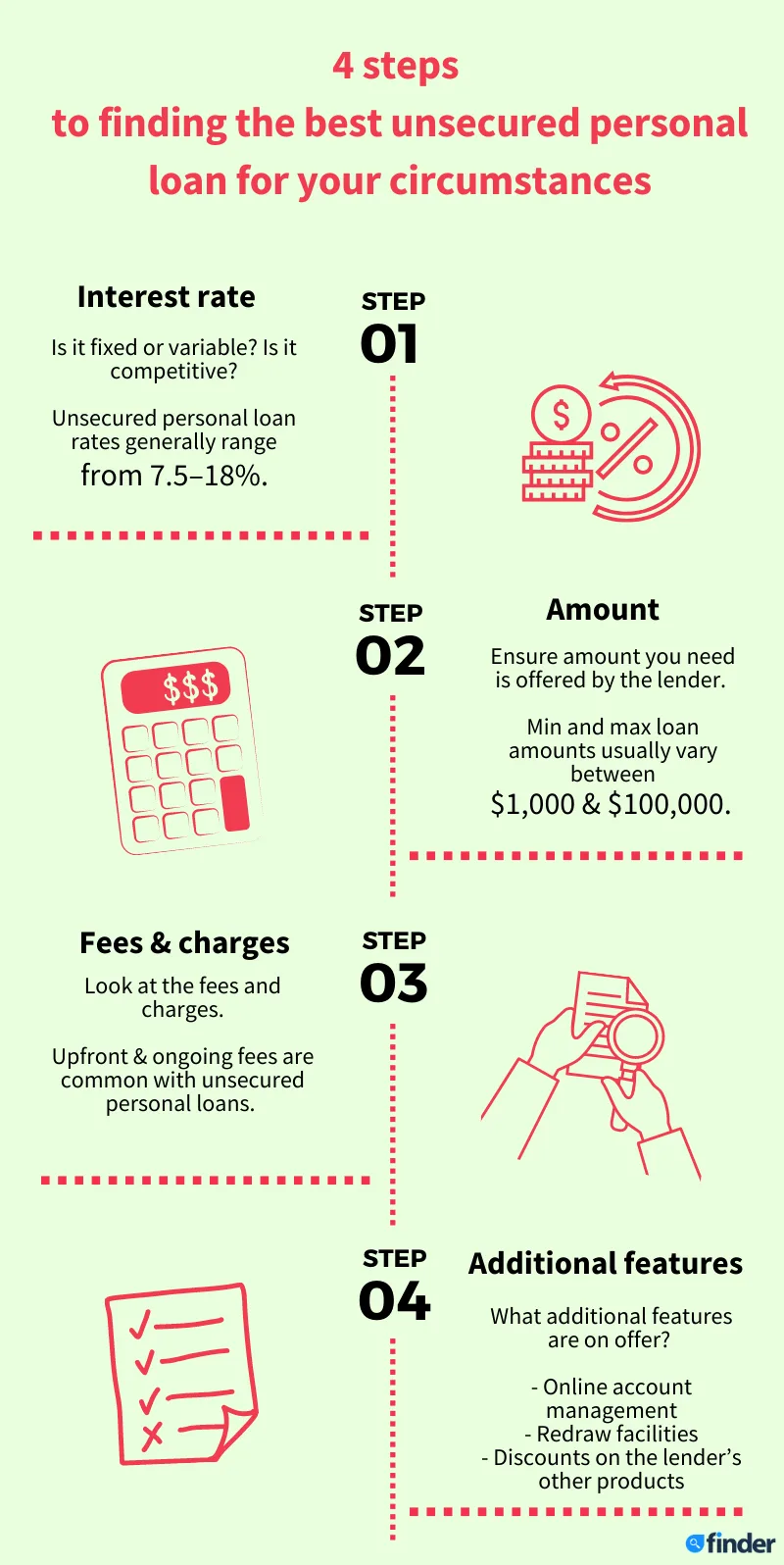

You will be given two options when it comes to your rate of interest: either a fixed or variable interest rate.

A fixed interest rate is when the rate of interest on your loan doesn't change over the life of your loan.

Conversely, a variable interest rate is when the rate you're paying can change over the period of your loan. This means that the rate can, but does not always, fluctuate. It can either increase or decrease throughout the term of your loan.

This is because variable interest rates are offered based on the rate set by the Reserve Bank of Australia (RBA). This is done eleven times a year. Based on this rate, each bank or non-bank sets its own rate of interest.

This means that if you opt for a fixed interest rate and the rate of interest drops, you may end up paying more. On the other hand, if the rate of interest goes up, you will end up paying a better rate.

We've provided an outline of unsecured loans with both fixed and variable interest rates below.

| Features | Fixed interest rate | Variable interest rate |

| Interest on repayments | Will not change over the loan term, remaining consistent throughout. | May or may not rise over your loan term. This means that you may or may not see an increase or reduction in your interest rates. |

| Budgeting | Easy to budget as your repayments remain the same every month. | Monthly budgeting may be tricky as the interest rate may vary on a monthly basis. |

| Loan terms | Ten years maximum. | Ten years maximum. |

| Break fees | This means that if you wish to pay off the loan early, you will incur additional charges. These penalties can sometimes be high. | Includes the option of repaying the loan early without penalty. |

| Additional repayments | May not have fees for additional repayments. This means that you may not incur charges if you make additional payments to pay the loan early. | No penalty for additional repayments, allowing you to pay the loan early if it is within your means. |

| Redraw facilities | Some fixed personal loans offer redraw facilities. This allows you to withdraw money if you need it. There may be charges. | Allows you to make extra payments and then withdraw that money if you need to, often free of charge. |

Once you've compared lenders, you need to ensure that you meet the eligibility criteria. Preparing all your documents before applying can make the process easier. To be eligible for an unsecured personal loan in Australia, you need to:

Now that you know what to look for, you can use our comparison table to find a loan that works best for you.

When you're ready to apply, you can click the "Go to site" button, where you'll be taken directly to the lender's website to complete the application.

If you're planning on taking out a loan, you may notice lenders advertising "personalised interest rates". The rate of interest quoted to you may also be different from that of someone else who applied for the same loan.

This is because the lender is basing the rate of interest on how risky it is to lend to you. A personalised rate is the rate of interest based on risk.

Lenders calculate this based on the loan amount you've requested, your credit status, how long you need to pay back the loan, your financial history and employment status.

You will be offered a lower rate if the lender thinks you are a low risk borrower and likely to pay back the loan on time. Conversely, if you fall into the high risk category, have other debts or lower income, you will receive a higher rate of interest.

Whether you are looking for a small or large unsecured personal loan, we've rounded up some tips to help you make the best choice.

| Tips for borrowing a small unsecured personal loan | Tips for borrowing a large unsecured personal loan |

|

|

|

|

|

|

|

|

Unsecured personal loans are offered both by large, traditional banks such as NAB, and non-bank lenders like OMM or Harmoney. Non-banks are governed by the same regulations as banks, so both options are equally secure.

The key difference between a bank and a non-bank is that non-banks hold a credit licence and not a banking licence. This means that they cannot provide some banking services, such as taking deposits. If you prefer to do all your banking in the same place, this may not be an option for you.

Typically, non-banks provide cheaper and more competitive products, with lower set-up and ongoing fees. However, they may have fewer loan options compared to traditional banks. Non-banks can also be more flexible and may provide better, personalised service when compared to traditional banks.

If you have a poor credit history, it may be more difficult to be approved for an unsecured personal loan, as the risk to the lenders is higher. However, there are some loans that specifically cater to bad credit borrowers. These include payday loans and debt consolidation loans. You can read more here.

If you are self-employed and have a good credit history, you can get an unsecured personal loan. To qualify for a standard unsecured personal loan, you may have to provide more documentation than a full-time employee. This could include:

You could also opt for a low documentation personal loan. These loans are easier to apply for and require less paperwork. Low documentation personal loans usually charge higher interest rates and fees.

Everything you need to know about this crucial payment.

Read more…

Struggling to repay your personal loan(s) as a result of COVID-19? Find out everything you need to know about what's being done to help people in your situation.

Read more…

Help with financial relief, insurance, Government stimulus packages, and more on where to get support during the ongoing COVID-19 crisis.

Read more…Check out Finder's guides to coronavirus and your finances

Some lenders may allow you to use the funds from an unsecured loan for business purposes, but others will not. You will need to confirm this with the lender before you apply. If you're looking for business finance, there are loans specifically designed for business purposes.

While unsecured personal loans do generally come with higher rates than secured personal loans, you can still find a competitive low rate personal loan option. Compare your options using the table above and find a loan that meets your budget. Don't forget to check the fees.

Whether a credit card or an unsecured personal loan is a better option depends on a number of factors, including how much you need to borrow, what you need the funds for, your income and your credit rating.

Fixed rate unsecured personal loans tend to offer terms of between one and five years, and variable rate unsecured personal loans tend to offer terms of between one and seven years.

There are two reasons this might have happened:

Matt Corke is Finder's head of publishing for rest of world and New Zealand. He previously worked as the publisher for credit cards, home loans, personal loans and credit scores. Matt built his first website in 1999 and has been building computers since he was in his early teens. In that time, he has survived the dot-com crash and countless Google algorithm updates.

You'll receive a fixed rate between 5.35% p.a. and based on your risk profile.

Apply for a loan up to $50,000 and repay your loan over 3 or 5 years terms.

You'll receive a fixed rate of 8.99% p.a.

Apply for up to $50,000 to use for a variety of purposes without needing to add security. Available to self-employed applicants.

You'll receive a fixed rate between 6.99% p.a. and 18.99% p.a. ( 7.91% p.a. to 19.83% p.a. comparison rate) based on your risk profile

Borrow from $5,000 to $55,000, with 1 years to 7 years loan terms available. This loan comes with no fees for extra repayments and no early exit fees.

You'll receive a fixed rate between 5.95% p.a. and 19.99% p.a. based on your risk profile

A loan from $5,000 to use for a range of purposes. Benefit from no ongoing fees and no early repayment fee.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

finder.com.au is one of Australia's leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines.

finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service.

Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan.

Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money here.

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

I am on a disability pension and want to pay off my credit card and Centrelink loans. Can you advise me of the best way to get a loan for $1000 please

Hi Karen,

Thank you for leaving a comment.

If you are looking to pay off your credit card balance and Centrelink loan, you may consider applying for a personal loan for debt consolidation. According to our review, Centrelink can be classed as genuine income by some lenders and can be used as income to assess your serviceability for a debt consolidation loan. It’s important to calculate your repayments and find out if your lender accepts your types of income. When you are ready, you may then click on the “Go to site” button and you will be redirected to the lender’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions. Hope this helps!

Cheers,

Reggie

Hi. I need a personal loan of 40k to pay off an existing loan and leave some to purchase a motorcycle. These sites are all just taking into consideration MY circumstances instead of the household income. My husband pays most things and I pay the existing loan and other insurance expenses etc. Who can I contact to get a loan which includes my household combined income?

Hi Colleen,

Thanks for getting in touch with Finder. I hope all is well with you. :)

I understand you’re looking for a lender that would consider your household income. Indeed, the majority of lenders would only assess your individual income primarily. However, we do have a page that lists lenders who provide personal loans on joint applications.

On that page, you will see a table that allows you to conveniently compare your options. You can compare according to the loan amount, fees, term payment, and so on. Once you have found the right one for you, click on the “Go to site” green button to learn more or initiate your application.

I hope this helps. Should you have further questions, please don’t hesitate to reach out again.

Have a wonderful day!

Cheers,

Joshua

am a starter in businesses and and i need loan $ 2500 to enable have the working capital and set up, am citizen of Kenya.. please advise

Hi Lilian,

Thanks for leaving a question on finder.

Unfortunately, the lenders featured on our website only caters to residents from the US, Australia, UK, Canada and New Zealand. You will have to check with your local lenders if you are not from those 5 countries I mentioned. Sorry about that.

Cheers,

Joel

Of all of CUA’s personal loans which ones can be used as an unsecured personal loan for ~$55000

Hi LM,

Thank you for you inquiry.

Unfortunately, there is no available unsecured loan from CUA. Thankfully, there is a list of unsecured personal loans featured on this page. Please go ahead and check them. You might find the right one for you through that page.

I hope this information has helped.

Cheers,

Harold

Hello

What will be the best loan option if I am looking at buying an overseas (Subcontinent) property. I am looking at around $150,000. I have a good paying job where I am making more than $10,000 pre-tax a month.

Hi Frank,

Thanks for your question.

If you’re looking for a personal loan, I’m afraid that these lenders featured on our site offer loans to Australian markets only and the maximum amount they can lend would be at $50K. Higher than that amount would generally be risky to most lenders. Usually, if you’re to purchase a property, the option you would have is to take a home loan, but again, the banks/lenders would only service the people in Australia and the properties would also be in the country.

Regards,

May