Looking for other insurance options?

Find out how to protect your finances during the global coronavirus pandemic with insurance.

Scan to download the Finder app on iOS or Android

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

We’re working hard to make sure our guides are up to date, but some information may not be accurate during this time. It's important to double-check all details before taking out cover. Some policies may not be available through Finder.

Browse Travel Insurance

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Keep up to date with how domestic travel rules and restrictions work.

Most travel insurance policies are unavailable right now, but we still want to help. Here's some useful info about getting on top of your finances, so there's less to worry about during this very weird time.

Travel insurance is an agreement between you and your travel insurer. You pay them a fee (also known as your premium) based on the risks associated with your trip. In exchange, your insurer agrees to pay you for unexpected bills related to your trip, up to an agreed amount. Travel insurance can help out in lots of ways by:

A few brands are starting to offer travel insurance benefits for the coronavirus pandemic. Cover is limited and it doesn't cover the expenses from border closures.

Don't forget to check the product disclosure statement (PDS) to understand what you're covered for.

| Brand | COVID-19 expenses | Cooling off period | Overseas medical expenses | Theft or damage to luggage | Standard excess | Apply |

|---|---|---|---|---|---|---|

| 21 days | Unlimited | Up to $12,000 | $250 | Get quote | |

|

| 21 days | Unlimited | Up to $15,000 | $250 | Get quote |

| 21 days | Unlimited | Up to $15,000 | $250 | More info | |

| 21 days | Unlimited | Up to $15,000 | $70 | More info | |

| 21 days | Unlimited | Up to $15,000 | $250 | More info | |

|

| 21 days | Unlimited | Up to $15,000 | $250 | More info |

| 21 days | Unlimited | Up to $8,000 | $250 | More info |

We don't charge you anything to compare policies with us. If you do choose to buy a policy by clicking through to one of our partners, you'll pay no more than going directly to their site.

Our unique algorithm ranks partners' policies based on how comprehensive they are – not by how much they pay us.

We write our content based on information travellers are looking for. We're an independent publisher and want to help you find the best information.

Enter your trip details into our search tool and you'll get a selection of quotes in seconds. Here are some other features our search tool can help you compare:

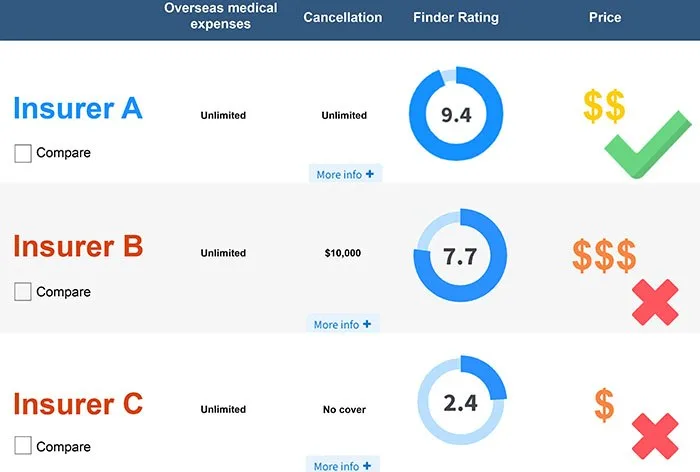

The finder rating gives you an idea of how comprehensive a policy is, based on how many benefits are included and to what extent.

You can sort travel insurance policies by price - budget to most expensive (and vice versa). It's always worth comparing prices to see if you can get more value.

If some policy benefits are more important to you than others, use the "More info" tab to compare included benefits and limits across different travel insurance brands.

Your claim will be voided if the insurer finds that you failed to act responsibly. Consider this before you have a few too many drinks on your trip or jump on a moped without a helmet.

Did you know that travel insurance will only cover you if you're riding with an Australian motorcycle licence, or a valid licence in that country? You also need to be wearing a helmet and stick to a specific engine size.

You'll need to pay extra for some high-risk activities such as skiing and motorcycling. This can be added when applying online. You'll find that most Australian insurers have a list of activities in the PDS which are covered for free.

Travel insurance can cover cancellations and injuries that arise from natural disasters depending on your policy type and when it was issued. If you buy your policy after the natural disaster becomes a "known event", you won't be covered.

If you're unsure about what to do when the unexpected happens, most insurers have a 24/7 emergency assistance line that you can contact. They will advise you on the right steps to take and help start your claim process.

It's important to know that travel insurance doesn't cover everything. Check out our guide for a list of common exclusions from Australian travel insurers.

Find out how to protect your finances during the global coronavirus pandemic with insurance.

There is no flat fee when it comes to travel insurance. The cost depends on a range of factors including:

Prices can also vary based on which travel insurance company you choose. The graph below shows how the price of travel insurance for a 7-day trip in Bali for a 49-year-old differs between insurers. You'll also notice the difference in price between travel plans (basic and comprehensive), because budget policies will generally cover less. This is why it's so important to compare travel insurance.

This graph was correct as of August 2019.

Answer text, add whatever content you need. Built to show links, standard formatting, symbols etc.

A handful of insurers offer some limited cover for COVID-19. You'll normally be covered if you get diagnosed with coronavirus and can't go on your trip, but you won't be covered for events like border closures.

Travel insurance is compulsory for some countries such as Cuba, Qatar, United Arab Emirates, Turkey and Belarus. even when it's not compulsory. Smartraveller.gov.au advises that if you can afford to travel, you can afford travel insurance. It's a small price to pay compared to the thousands you could lose if something unexpected happens.

On average, a travel insurance policy to Bali for 2 weeks for a 30-year-old is $56.84 (as of February 2020), but the cost of travel insurance can vary, so you should always compare your options. You can get cheaper policies with fewer inclusions, or more expensive policies with upgrades. When looking for travel insurance, the way to get the most value is to consider your trip and only get cover for what you need.

Flight insurance is sometimes offered by airlines to cover you for the costs of flight cancellations and delays. It only covers flight-related expenses compared to travel insurance which is more inclusive. Travel insurance can protect your entire trip including your flights, overseas medical costs and luggage to name a few.

A PDS (Product Disclosure Statement) is a legally binding document that outlines what you're covered for. If something's not mentioned in a PDS then that insurer won't cover it. You'll also find a list of common exclusions, which are events you won't be insured for.

Travel insurance will typically pay for emergency medical expenses up-front if you need, but you'll have to get in contact with your insurer as soon as possible to arrange it.

If your condition isn't major and you don't have to pay a lot, it might be easier for you to claim your expenses when you get back home.

In insurance, a known event is an incident that has been reported by the media or government, e.g. a planned pilot strike or weather warning. If you buy travel insurance after these incidents become known events, you most likely won't be covered for any related claims.

An excess is the out-of-pocket expense you'll have to pay if you need to make a claim on your travel insurance policy. Depending on how risk-averse you are, you can opt for a higher excess, which will mean lower premiums (policy cost), but this might mean that smaller claims are not worth it.

Most Australian insurers will have an age limit for seniors which can vary from 65 onwards. Those that do cover all ages often have limits on trip durations and exclusions on pre-existing conditions.

Most policies will cover kids for free if they're travelling with the parent or guardian listed on the Certificate of Insurance. You usually need to be under 21 to be eligible as a dependent, though this varies between brands.

Complimentary credit card travel insurance often comes with more conditions and exclusions than a standalone policy.

You should always read the Product Disclosure Statement (PDS) for the fine print regarding the excesses you will have to pay, the benefit limits, the maximum trip duration and which pre-existing medical conditions are automatically excluded.

If you find the few dollars you save isn't worth the risk of being underinsured, consider taking out a standalone policy instead.

Depending on your condition and the insurer, you might be automatically covered for free, you may have to pay more for a policy, or you might not be covered at all. Either way, be sure to let your insurer know about your pre-existing conditions when you apply. Otherwise, any related claims you make are likely to be denied.

Picture: Getty Images

Jessica Prasida is an associate publisher for Finder specialising in travel and home insurance. She loves travelling and is a wannabe dumplings master. Jess has a Bachelor of Business from the University of Technology Sydney and a Tier 1 General Insurance qualification. She is currently studying a Master of Marketing.

Your guide to how the Financial Ombudsman Service can help resolve disputes between you and your travel insurer.

Airline lost your luggage? Here's what you need to know.

Find out how travel insurance covers frequent flyer points if you need to cancel.

Here's how to navigate your holiday if you bought travel insurance too late.

We analysed 31 travel insurance policies to see what's really covered.

South Korea has become a tourist hotspot in recent years, and is usually a very safe choice if you travel smart.

From water and food safety to trips for solo travellers, this is your guide to make sure you stay save on your trip to Egypt.

A complete guide to making sure you have a safe trip to South Africa.

Worried about the water quality, food safety or terrorism in Cambodia? Here’s all you need to ensure your trip to Cambodia is safe.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

finder.com.au is one of Australia's leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines.

finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service.

Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan.

Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money here.

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

I would like a years travel insurance worldwide please advise

Hi Mike,

Thanks for getting in touch! It’s great to know that you are looking to get travel insurance. To get started, please utilize the online form found on top of the page above. Enter all the details needed in the form and press GET MY QUOTE. Once done, you will see a list of providers that may review your insurance inquiry. If you need further help, a quick guide on how to compare travel insurance is also included on the page.

As a friendly reminder, carefully review the Product Disclosure Statement of the product before applying. You may also contact the insurance provider should you have any questions about their policy.

Hope this helps and feel free to reach out to us again for further assistance.

Best,

Nikki

Do I need to purchase Travel insurance before I pay for flights etc?

Hi Lorelie,

Thanks for reaching out to us at Finder!

There’s nothing stopping you from purchasing travel insurance before you pay for flights but typically, people usually buy it after or at the same time of booking.

This is because your flight dates will generally confirm your travel dates. You’ll have a confirmed flight itinerary and be able to match those dates to the date range you’ll need cover for.

I hope you find this helpful.

Kind regards,

Jessica

How long before I travel should I purchase travel insurance?

Hi Lorelei,

Thanks for getting in contact with us at Finder!

We always recommend buying travel insurance as early as possible. This is so that you can take advantage of cancellation benefits in case something out of your control happens.

Most policies cost the same if you buy it today, versus if you but it later, so generally; you’ll get better value out of buying it earlier.

I hope you found this helpful.

Kind regards,

Jessica

How can I get travel insurance for a boat cruise for the 25/02/2020 going to the South Pacific islands. Our ages are 78 and 75 respectively. Is there any chance on getting yearly insurance or is it just for a single trip. Thank you.

Hi Delia,

Thanks for getting in contact with us at Finder!

From my research of over 15 of our travel insurance partners, InsureandGo travel insurance offers annual multi-trip policies for people up to the age of 100. Their annual multi-trip policies also offer automatic cover for on-board hospital and medical expenses as long as any pre-existing conditions are declared.

If you decide to choose a single trip policy instead, head to our cruise travel insurance page and enter your trip details into the comparison tool to compare quotes for eligible policies.

I hope this has been helpful.

Kind regards,

Jessica

Are there any insurance companies that cover Outdoor Rock Climbing without a guide. My son has already left Australia.

Hi Matilda,

Thanks for your message. Yes, there are insurers offering rock climbing travel insurance, however, they require all climbs to be with a professional/guide. Given that your son is already overseas, you may want to reach out to insurers for travellers outside Australia. As a friendly reminder, carefully review the Product Disclosure Statement of the product before applying. You may also contact the insurance provider should you have any questions about their policy.

Hope this helps and best of luck in finding an insurer for your son!

Best,

Nikki