Small Business, Hospitality and Tourism COVID-19 Support Grant

Amount available

Between $5,000 and $10,000.

What is the funding for?

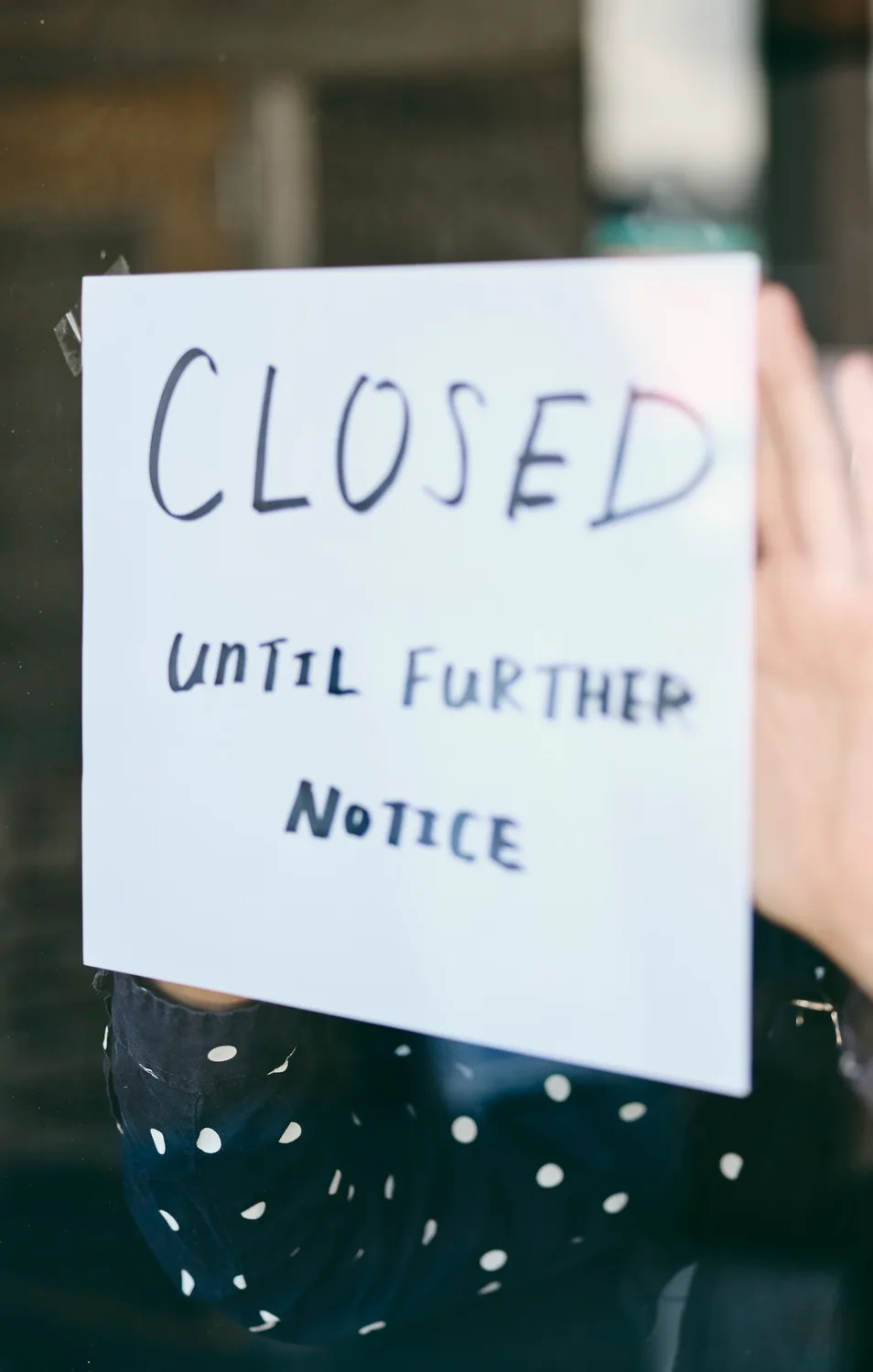

The New South Wales state government is giving small businesses, hospitality and tourism businesses across NSW grants from $5,000 up to $10,000. This grant applies to businesses affected by the lockdown starting 26 June 2021. The grants are intended to help businesses alleviate cash flow constraints and pay for expenses like rent, utilities and wages.

The grants are available across NSW, including regional areas. This is to ensure that regional businesses, which would have received income during the school holidays, are also covered.

Who's eligible?

If your business has experienced a decline in turnover, you can apply for these grants. Amounts will vary depending on the percentage of decline. Businesses can expect:

- $10,000 for a 70% decline

- $7,000 for a 50% decline

- $5,000 for a 30% decline