OurMoneyMarket Personal Loan

From

fixed rate

From

comparison rate

Rate dependent on risk profile

Go to siteScan to download the Finder app on iOS or Android

From

fixed rate

From

comparison rate

Rate dependent on risk profile

Go to siteWe’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

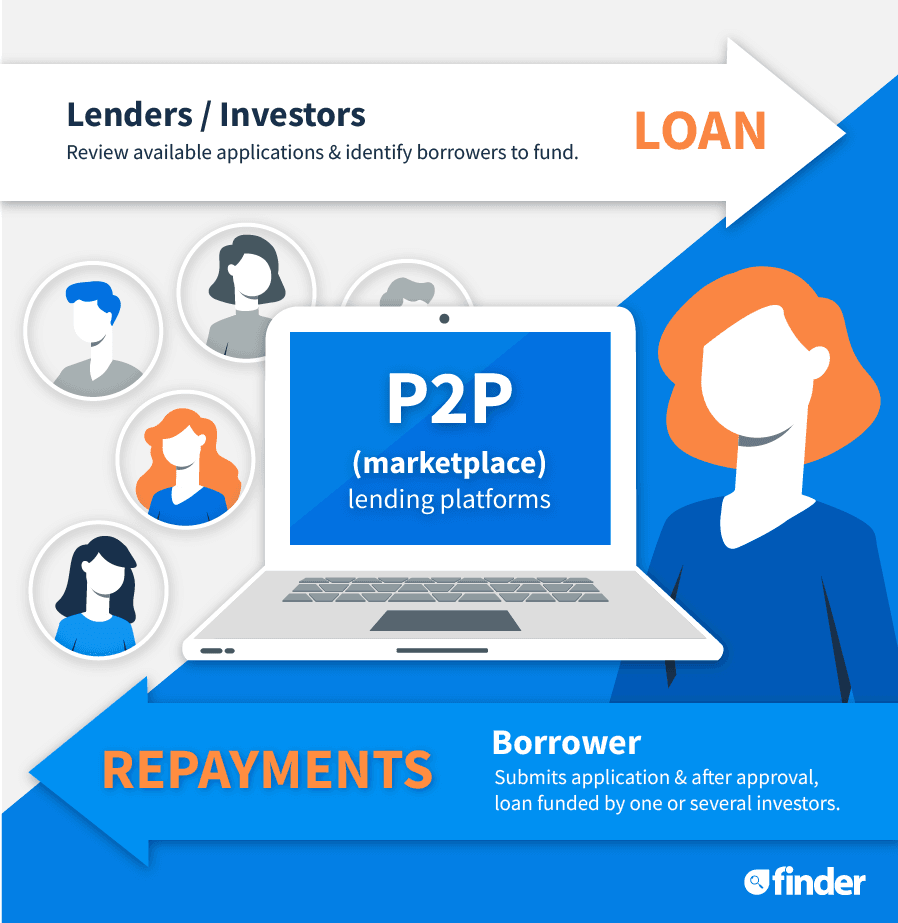

Peer-to-peer (P2P) personal loans are a type of P2P loan. P2P lending, also known as marketplace lending, is a type of finance where the loans are funded by multiple investors. Instead of banks, building societies or credit unions. This type of finance can benefit borrowers by giving them access to potentially lower rates than their corporate competitors and by having more relaxed lending criteria.

P2P lending has the benefit of offering borrowers personalised interest rates. This means that good credit borrowers are rewarded with lower rates, and borrowers with poor credit, while usually having to pay more, have access to options that they would otherwise have not qualified for. Investors can also benefit from this type of finance, as P2P platforms often see a higher return than savings accounts, term deposits and other investments.

Finding a personal loan with favourable terms doesn't have to be difficult, no matter what you're borrowing for. If you're looking for a competitive personal or business loan, consider the benefits that P2P lending has to offer.

Taking out a peer-to-peer loan involves borrowing money from individual investors, where the "lender" simply acts as a facilitator for the loan. By lending their money, the investors gain access to an attractive fixed income asset class that can yield better returns than other investment options. Borrowers can also take advantage of lower rates that are based on their credit scores. All this is facilitated by a peer-to-peer lending platform that connects the people looking to borrow with people looking to invest.

Peer-to-peer (P2P) providers do not match individual lenders directly with a borrower. Rather, they enable the lender to invest in a portfolio of consumer loans. In other words, the P2P provider facilitates a platform where investors can finance a portfolio of loans and earn interest on what they lend, while borrowers are given an individual rate based on their credit score.

Various lenders offer peer-to-peer loans in Australia, each with its own product offering and rate. The table below is a quick guide to Australia's P2P lending landscape:

| Peer-to-peer lender | Type of loans offered | Loan amount | Loan term |

|---|---|---|---|

Business loans | $100,000 up to $10,000,000 | 3 to 5 years | |

Personal loans | $5,000 to $80,000 | 3 to 7 years | |

Personal loans | $5,000 to $50,000 | 12 to 84 months | |

Personal loans | $5,000 to $50,000 | 1 year to 2 years | |

Business loans | $50,000 to $300,000 | 2 years and 5 years | |

Business loans | $30,000 to $500,000 | 1 to 5 years | |

Business loans | $10,000 to $5,000,000 | 12 to 60 months | |

Personal loans | $5,000 to $30,000 | 3 to 7 years |

The Government Backed Guarantee on Deposits was set up to protect investments up to $250,000. They do not apply to funds in peer-to-peer lending as it only applies to institutions authorised by the Australian Prudential Regulation Authority (APRA).

When peer-to-peer personal loans launched in Australia, one new aspect about these loans was that the interest rate was personalised to the borrower. Now, banks and other non-P2P lenders have been embracing this. You can now find many risk-based personal loans from major banks as well as smaller standalone lenders and credit unions.

Many banks and lenders are also offering more competitive rates and embracing innovative technology in order to remain competitive.

Check the credibility of the website or platform that you're considering. They should have a credit license listed on the bottom of the page and check what banks or services they are affiliated with.

The rates offered by the peer-to-peer lender are usually lower than those offered by the banks, but you should also see whether they are fixed or variable.

Take a look at the comparison rate to see how much the loan is likely to cost you with the fees included, and remember to check whether you will need to pay any upfront fees to set up the loan.

Some peer-to-peer lenders may not be able to offer you as high a loan amount as other banks or lenders, so check to see that you'll be able to borrow what you need for as long as you need it.

The lender's reputability should also form part of your comparison. You might want to read independent customer reviews online, see how easy the lender is to be contacted, and how transparent they are with their fee and rate information.

As a borrower, you want to ensure the person you will be borrowing from is reliable and that the lender has strict guidelines in place to ensure no unscrupulous investors find their way into the lending network. Check out the lending requirements before you apply to see the type of people you will be borrowing from.

While you want to check that you are eligible, you also want to ensure that the peer-to-peer network doesn't have borrower eligibility criteria that are too relaxed. Some overseas peer-to-peer networks who started lending to borrowers with bad credit failed due to a high number of defaulted loans, so you want to ensure the lender you go with doesn't engage in high-risk borrowing behaviour.

Peer-to-peer lending is an alternative credit option to consider. With competitive rates, quick approval times, and not to mention a way for investors to diversify their portfolio, peer-to-peer lending is making its mark on the credit industry.

Elizabeth Barry is Finder's global fintech editor. She has written about finance for over six years and has been featured in a range of publications and media including Seven News, the ABC, Mamamia, Dynamic Business and Financy. Elizabeth has a Bachelor of Communications and a Master of Creative Writing from the University of Technology Sydney. In 2017, she received the Highly Commended award for Best New Journalist at the IT Journalism Awards. Elizabeth's passion is writing about innovations in financial services (which has surprised her more than anyone else).

Discover the features and benefits of Australian Unity’s Wealth Builder Investor Package variable rate home loan.

A review of G&C Mutual Bank’s fixed rate home loan. Discover the features and benefits of this loan.

How to get your finance sorted BEFORE you start property shopping, so you know exactly how much you have to spend and what your budget is.

Are you an existing Commbank home loan customer looking to make your home more energy-efficient? Apply for a 0.99% p.a. Commbank Green Loan for up to $20,000. No fees attached.

SPONSORED: Lenders want to be sure you can pay them back without any major problems. Here's how to show them you can.

Nexo is a cryptocurrency lending and borrowing platform that offers high interest rates on cryptocurrencies, stablecoins and fiat. We review the features available and look at how safe your funds would be on the platform.

Centrelink might block your business idea from taking off, but a variety of finance options including government schemes can help your business succeed.

We explore how to use Compound Finance for lending and borrowing.

A Green Loan from Handypay could help you make your home more energy-efficient. Handypay green loans are available up to $75,000 on terms of up to 10 years.

You'll receive a fixed rate between 5.35% p.a. and based on your risk profile.

Apply for a loan up to $50,000 and repay your loan over 3 or 5 years terms.

You'll receive a fixed rate of 8.99% p.a.

Apply for up to $50,000 to use for a variety of purposes without needing to add security. Available to self-employed applicants.

You'll receive a fixed rate between 6.99% p.a. and 18.99% p.a. ( 7.91% p.a. to 19.83% p.a. comparison rate) based on your risk profile

Borrow from $5,000 to $55,000, with 1 years to 7 years loan terms available. This loan comes with no fees for extra repayments and no early exit fees.

You'll receive a fixed rate between 5.95% p.a. and 19.99% p.a. based on your risk profile

A loan from $5,000 to use for a range of purposes. Benefit from no ongoing fees and no early repayment fee.

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

finder.com.au is one of Australia's leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines.

finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service.

Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. You should consider whether the products or services featured on our site are appropriate for your needs. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan.

Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money here.

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Hi Team i would like to apply for a combine ptop lone with my wife i have high credit score and 4 month’s working& Wife has average credit score but 2 pluss years in job is this possible please.

Hi Cristopher

Thanks for getting in touch! To apply for a peer-to-peer personal loan, check the eligibility criteria of the loan before applying to increase your chances of approval. Read up on the terms and conditions and product disclosure statement and contact the bank should you need any clarifications about the policy.

Our page shows a list of P2P lenders. I also suggest reading the part on the page that says “How do I compare my options?” to help you decide which lender to go for!

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

Best,

Nikki

Hi Team,

I would like to invest in a P2P loan.

Is this possible if I am not an institution?

Do I need to be a ‘sophisticated’ investor?

If not, which P2P lenders will allow me to make an investment?

Thanks!

Sammy

Hi Sammy,

Some P2P lenders require to you be a sophisticated investor while others allow non-sophisticated investors to lend. Here are the requirements for some prominent P2P lenders:

– SocietyOne: Need to be a sophisticated investor

– RateSetter: Individuals over the age of 18 can lend from just $10

– MoneyPlace: Currently need to be a wholesale or institutional investor, but retail investors are coming soon

– Harmoney: Currently only sophisticated investors can apply, opening to retail investors soon

– Marketlend: Open to retail investors

Hope this helps,

Elizabeth

Do you have a comparison page for investors? Specifically I want to know which platform and investment has the lowest default rate.

Hi J,

Thanks for your inquiry.

I believe when you said investor, you mean you’re looking for business loans. If this is correct, please check our list of business loans. On this page, you’ll read more details about business loans, how to apply, and compare your options.

I hope this helps.

Cheers,

Danielle

I am looking at investing in buying a 20 year lease on a Holiday Park which has excellent proven turnover of a million plus per annum and approx six to seven hundred thousand profit after running costs and GST. The problem is that they are asking for $1,250 000.00 up front. I am unable to borrow that much from a bank as I don’t have that much security to cover it. Do you know of any business that could assist me in obtaining this amount of money. I would be asking for a 5 to 7 year loan to pay it back with interest of course.

Thanks

Ian

Hi Ian,

Thanks for your question.

You can take a look at our business loans guide that also provides you with a few options but the maximum loan amount from the lenders available is $500,000. While you might not be able to provide security, you still might want to get in touch with banks, if you can provide a business proposal they may be able to offer you financing. You can also think about getting in touch with a business loan broker to help you source financing. The business loan guide provided in the link may offer some more guidance.

I hope this has helped.

Thanks,

Elizabeth

am joseph from kenya.my question is am i eligible for a loan of 500$ or its only citizens of australia who qualify alone.

Regards

Hi Joseph,

Thanks for your question.

You may be eligible for a loan from peer-to-peer lenders such as Society One, as they simply require you to hold an Australian bank account and be over the age of 21. For your other loan options, you can take a look at our guide to loans for temporary residents.

I hope this has helped.

Thanks,

Elizabeth

I need to borrow $25000 to settle my separation..since my separation i took on all the family debt and in 5 yrs have paid off a 26000 personal loan and credit cards to 36000, my credit rating is below average but i only wish to borrow this money till late July 2015 4mths because i can them access my superannuation which i have $390000.

Hi Risto,

Thanks for your question.

If you would like to discuss your eligibility or options, please get in touch with a lender from the peer-to-peer loan products we have compared.

We also have a guide to bad credit personal loans that may assist you. Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you.

Cheers,

Shirley