NAB Credit Card Offer

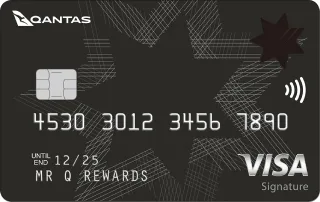

NAB Qantas Rewards Signature Card

Up to 110,000 bonus Qantas Points

Discounted $295 first year annual fee

Eligibility criteria, terms and conditions, fees and charges apply

NAB Credit Card Offer

Earn up to 110,000 bonus Qantas Points, take advantage of complimentary insurance covers and a 24/7 concierge service.

- 90,000 bonus Qantas Points (spend $3,000 within the first 60 days) and 20,000 points after 12 months

- First-year annual fee of $295 ($395 p.a. thereafter)

- 19.99% p.a. purchase interest rate | 21.74% p.a. cash advance rate

- Minimum credit limit of $15,000

I am looking for a NAB pre paid everyday mastercard/

Can’t find on your website

Hi Laurelle,

Thanks for your message.

It appears that NAB Prepaid Everyday Mastercard is not offered on our website. If you are still looking for an everyday transaction account from NAB, you may consider opening a NAB Classic Banking Transaction Account. The Classic account comes with a NAB issued Visa debit card. This card can be used to make purchases at locations where debit cards and Visa credit cards are accepted forms of payment. Otherwise, you may refer to our list of other everyday transaction accounts.

As a friendly reminder, review the eligibility criteria, fees, interest rates, and terms & conditions of this account before applying. You may also contact the bank should you have any questions about their product.

Hope this helps!

Best,

Nikki

Can I get a NAB Low Rate Card on a temporary visa?

Hi Deez,

Thank you for leaving a question.

The NAB low-rate credit card does not accept applicants on temporary visas. If you press the ‘More info’ link, it will redirect you to our product review page . Form there, look for the Eligibility tab to check the residency requirement per card.

You may also refer to our list of credit cards for temporary residents to compare credit cards that temporary visa holders can consider.

Hope that helps.

Kind Regards,

Mai

How do I calculate the minimum payment over the next 10 years?

Hi Peter,

Thank you for getting in touch with Finder.

Please note that all credit cards have minimum repayments, which usually are calculated as 2% or 3% of your total balance charged that statement period.

I hope this helps.

Thank you and have a wonderful day!

Cheers,

Jeni

How does balance transfer cards work? One has to apply for balance transfer amount at the time of application, if I am not sure, how much I need to balance transfer (I have not made any expense from my existing card)? Can I just apply for tentative balance transfer amount and once I my expenses limit (From existing card) reach to balance transfer amount, I simply call bank and ask them to transfer?

Hi Aj,

Thanks for your inquiry

You may check our page on how a balance transfer works.

The amount you may be able to transfer will depend on the bank. Some banks allow you to transfer 90% of your credit limit.

Please check out these balance transfer credit cards and get 0% interest for up to 24 months and save money with balance transfer credit cards.

Once you have chosen a particular card, you may then click on the “Go to site” button and you will be redirected to the bank’s website where you can proceed with your application or get in touch with their representatives for further assistance.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Hope this information helps

Cheers,

Arnold

Hi, I recently opened a Platinum dual credit card with NAB, and on the finder website, it said there is a 50,000 Qantas bonus points if you spend $2,500 within first 3 months. The bank doesn’t seem to know about this and I cannot now find this on the finder website. Can you please elaborate?

Thank you

Hi Ian,

Thanks for reaching out to us.

You might be referring to NAB Rewards Platinum Card where you can get 50,000 bonus points in the first 60 days when you meet the spend requirements. Plus earn at least 2 points per $1 spent in the first 6 months (capped at 10,000 per month). You can check our page about NAB Rewards Platinum credit card to learn more.

You may avail of this by clicking the ‘Go to site’ from our finder page then it will direct you to NAB official site to submit an online application.

Cheers,

Rench