- Google Pay, Apple Pay, Samsung Pay, Fitbit Pay, Garmin Pay

- Monthly fees: $0

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

Headquartered in Tasmania, MyState has been an active alternative to big banks for over 50 years. It provides a large range of personal banking products and services, covering everything from insurance to high interest savings accounts. This guide will outline the various transaction and savings accounts plus the term deposits the bank offers.

You can find a list of accounts available from MyState below.

MyState is a financial institution with its head offices located in Hobart, Tasmania. It offers a complete range of personal banking solutions, from transaction accounts and savings accounts to personal loans and home loans. Whether you are saving for a specific financial goal in the future, or just need to keep your bill money separate from your spending, MyState may have the solution. Customer dposits up to $250,000 per customer are guaranteed by the Australian Government.

With a limited branch network to serve customers and all branches located in Tasmania, MyState relies heavily on its online banking service to meet the financial needs of customers outside of the region. Through it’s internet banking portal you are able to easily manage your accounts, access balances, and set up electronic deposits and debits.

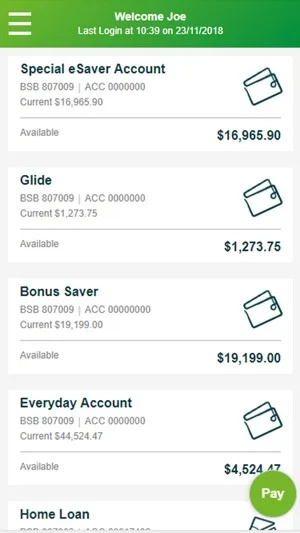

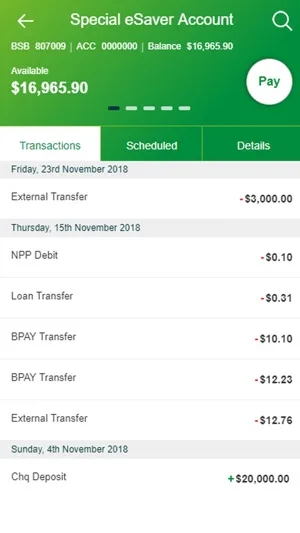

MyState also offers a mobile app, so you can manage your money on-the-go, wherever you may be. The app can be downloaded on both Android and iPhone devices.

| Login | Accounts | Transactions |

|---|---|---|

|  |  |

You can easily apply for an account with MyState online. The process is simple and takes less than 10 minutes. You'll need to provide you personal contact details, including your residential address and also your tax file number. Plus, you'll need to verify your identity with either your drivers license, passport or birth certificate. After the account has been opened you will be sent the details along with any linked debit card you may have chosen.

Pay $0 account keeping fees and make payments using Apple Pay, Google Pay or Samsung Pay with your MyState Glide Account.

Earn up to 1.20% p.a. on this high interest savings account each month you deposit $20 and make 5 Visa Debit card transactions.

Enjoy full access to your account with a linked Visa debit card and mobile app plus access Apple, Google and Samsung Pay to leave your wallet at home.

Lock your money away for just one month or for two years and be rewarded with guaranteed returns on your investment.

A savings account that offers competitive tiered interest rates, easy access to your money and no account keeping fees.