A line of credit (or a home equity loan) allows you to borrow money using the equity in your property.

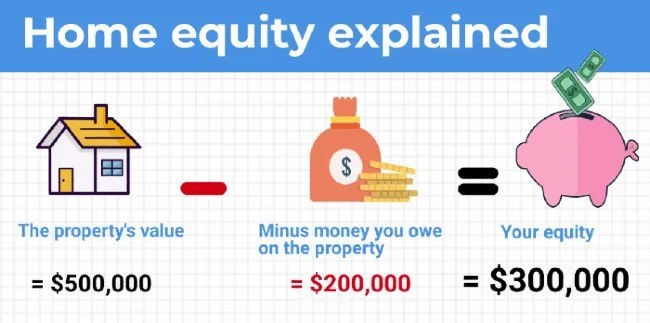

Equity is the value of your home minus any money you owe on it. If your home is worth $500,000 and you owe $200,000 on your mortgage, then your equity is $300,000. Using a home equity loan, you can access some of that money (up to 80% of the property's total value) to spend on anything you want.

But are there any limits or guidelines about how you spend the money? And are there any risks?

I own my house that

We own our house and want to take out a line of credit for 100k and our house is valued at 850k

I am a sole operator of a small business that only turns over around 20-30k, my question is if my low income isn’t enough to meet the application credentials can I use a guarantor for this type of loan?

Regards

Chris.

Hi Chris,

Thanks for getting in touch with Finder.

The answer to your question is yes. It is possible to use a guarantor for a line of credit loan. However, it would still depend on your chosen lender whether they accept such arrangements or not. Your house is already good collateral for your loan and so, lenders might still consider your application even if you don’t have a guarantor. There are lenders offering secured personal loan options that allow you to use your home equity as a guarantee that you might want to consider. But of course, having a guarantor can increase approval especially if the guarantor has a good credit score and financial standing.

For this reason, I highly recommend that you get in touch with your chosen lender and determine whether they accept a guarantor or not. Here’s our list of guarantor personal loans if you’d like to compare your options. You can use our comparison table to help you find the lender that suits you. When you are ready, you may then click on the “Go to site” button and you will be redirected to the lender’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

I hope this helps. Should you have further questions, please don’t hesitate to reach out again.

Have a wonderful day!

Cheers,

Joshua

Hi

My home is valued at approx. $650K

I currently have around $30K to pay off

I have a current like of current of $59K

I am looking to purchase a investment property

I am employed full time

How much can I borrow

Hi Rav,

Thank you for your inquiry.

It woul be nice getting in touch with a licensed mortgage broker so that you can review your borrowing capacity. A broker can help you understand your financial position and they can leverage their panel of networks to find a lender that’s more inclined to review your application.

Moreover, I’m afraid we can’t really tell you how much you can borrow because we are not a lender and the answer would depend on your whole financial situation. Thankfully, you can check our borrowing power calculator to get an idea how much you can borrow.

I hope this information has helped.

Cheers,

Harold

I have a 50,000 home loan / line of credit. When I was notified by the bank that the loan was switching from interest only to monthly principal + interest and this would equal 440 / month, I paid 48,500 dollars off the loan in order to reduce my principal. The bank has continued to charge me 440 per month, vent though my loan balance is now $1500. Is this legal? They say that I have the ability to use the 48,500, so I need to pay $440 a month for this privilege. What?

Hi Shelley,

Thank you for your inquiry.

With your current situation you would need to read your loan docs or get a financial advisor/accountant or mortgage broker to read them to help understand how the bank is able to do this.

I hope this information has helped.

Cheers,

Harold

My home is worth $3 million. I want a line of credit of $900,000 to buy a property. I own my home how do I do this and how much are repayments?

Hi Roslyn,

Thanks for the question.

You can compare and apply for line of credit loans using the table on this page. Select the ‘Go to site’ buttons to be taken to the lender’s site and discuss your options and start the process. Alternatively, you can start speaking to a mortgage broker by selecting the ‘Speak to a mortgage broker’ tab and filling out the form.

Your repayments will depend on how much you withdraw and how you choose to use them.

You can use our calculator to get an idea of what your repayments would be.

I hope this helps,

Marc

Hi

I was looking at getting line of credit against my home.

I own my own home , value about $850,000 and I have no mortgage

I don’t have any debt, I have substantial money saved , I have full time job.

I am looking at buying some investment property , when I contacted one of the lenders, I was only given $300,000

I thought I was able to get more like the 80% value of my home.

Hi Ivana,

Thanks for reaching out.

If you’d like to understand your borrowing capacity, you can use our borrowing power calculator, which takes into account your income, liabilities, and the number of dependents that you have.

Keep in mind that lenders have different eligibility criteria for different loans and this criteria can be more stringent for line of credit (LOC) and investment loans (particularly after APRA’s intervention).

I recommend getting in touch with a licensed mortgage broker, so that you can review your borrowing capacity and your propensity to repay a loan. A broker can help you understand your financial position and they can leverage their panel of networks to find a lender that’s more inclined to review your application.

All the best,

Belinda