Get exclusive money-saving offers and guides

Straight to your inbox

Finder's rating: 4.2/5

★★★★★

IG is a global online share trading provider, offering traders access to Australian and international shares. They’re known for charging some of the lowest brokerage fees on the market, starting with zero commissions for global stocks and $5 for ASX shares.

AUD $8 or 0.1%

Standard brokerage fee

ASX, NASDAQ, NYSE, London Stock Exchange, DAX, ISEQ

Available markets

Phone, Email, After hours

Support

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

| Type of broker |

Online only |

|---|---|

| ASX products |

Shares |

| Available markets |

ASX NASDAQ NYSE London Stock Exchange DAX ISEQ |

| Standard brokerage |

AUD $8 or 0.1% |

| Support |

Phone After hours |

IG is a global, trading industry giant. Founded in 1974, IG has more than 40 years experience offering competitive trading options to international clients. With more than 239,000 clients worldwide and net global trading revenue of £388.4 million, IG is the world's (and Australia's) largest provider of CFDs.

While fully embedded in the international forex and CFD industry, the IG share trading account is a relatively new addition to the company's account suite. By entering the share trading space, IG is positioned to allow current CFD trading clients to access Australian and international shares without having to open an account with another broker, while offering a premium product to attract new business.

If you're thinking of opening an IG share trading account, then these key features will most likely be what sways your final decision. Take the time to research and compare them with other brokers and you'll immediately notice that IG stacks up favourably against their key Australian share trading competitors.

| Fees |

★★★★★ 3.4/5 |

Brokerage fees are among the lowest however there is an account fee to consider. |

| Trading tools |

★★★★★ 4.5/5 |

It offers charting tools, conditional orders and margin trading options. |

| Research and education |

★★★★★ 3/5 |

IG features a live demo and news updates. It does not offer stock rating tools. |

| Available securities |

★★★★★ 4/5 |

It offers stocks, ETFs, forex and CFDs. |

| Customer support |

★★★★★ 5/5 |

IG is rated highly thanks to 24/7 live chat support, phone and email support services. |

IG customers can access news, advice, webinars and recommendations from IG's team of in-house experts. The IG website houses an excellent market analysis section, boasting articles and videos from some excellent analysts. This includes trading opportunities, as well as information on stocks to watch.

IG Academy offers free online courses, webinars and seminars to help you to develop trading skills in stocks, forex and CFDs.

Brokerage costs with IG are some of the lowest in the industry. Starting at just $5.00 per trade on Australian shares and $0 commissions per trade on global shares.

You can place share trades with IG through the provider's web-based trading platform, over the phone or through the IG app. Share trading apps are proving to be a hugely popular medium and the IG trading app is available to suit both Apple and Android smartphones and tablets.

IG Share Trading provides access to more than 11,000 Australian shares, as well as thousands more from markets around the world. For a list of the international stock exchanges you can buy shares on via your IG share trading account, check out the list below.

An IG share trading account provides investors access to more than 13,000 shares, across both Australian and international markets. The stock exchanges you can access through your IG Share Trading account include:

If you're not looking to invest in shares and are instead interested in taking more of a short term approach, then perhaps trading CFDs might be more suitable for you. If this sounds like the case, take a look at our review of the IG forex and CFD trading account.

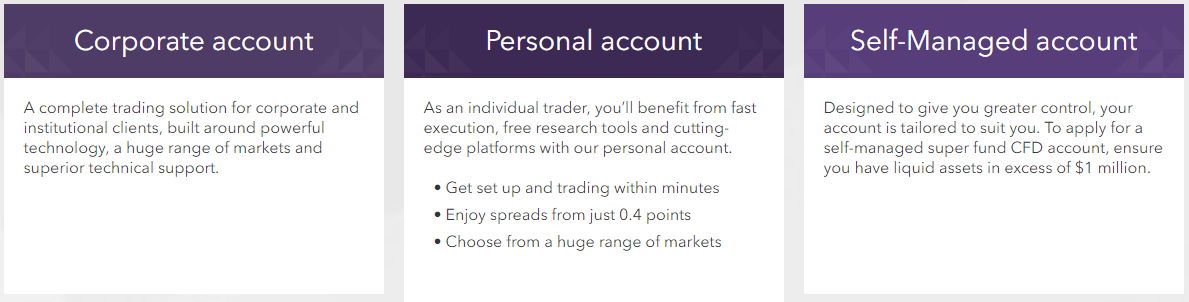

The following table has been sourced from the IG website and clearly places the different account types side by side. Take a look and use it to help decide which is best suited to you and what you're trying to achieve from trading.

IG offers a 24-hour customer support service. The first step to take when you need assistance is to visit IG's extensive online help portal.

If you can't find the answer you're looking for among the frequently asked questions, you can email your question to IG, free call the experienced customer help team directly or jump on live chat.

IG Academy also contains a big range of educational resources and IG community allows users to access forums, get trading tips and interact with other members.

As well as brokerage, an IG share trading account has a number of fees and charges that you need to be aware of.

You have a few options when it comes to broker (aka commission) fees which will come down to how often and how much you trade each month.

The brokerage fee for Australian shares starts at $5 a trade, however this is only if you've made three or more trades in the previous month. If you've only made 1-2 trades, your broker fee will be the standard $8 per trade or 0.1% (whichever is higher).

For international markets the commission fee is $0, however you're charged a foreign exchange fee of 0.70% per trade if you choose this route. The other option here is to convert currencies outside of IG – this means you avoid the high FX fee, but must pay $10 per trade in commissions.

The following table breaks down the brokerage fees across Australian and its international share markets for phone or online trades.

| Location | Commission per trade |

|---|---|

| Australia | AUD$5 per trade (if you make 3+ trades in the previous month), or $8/0.1% (whichever is higher) |

| US | $0 |

| UK | $0 |

| Germany | $0 |

| Ireland | $0 |

| Location | Minimum charge |

|---|---|

| Australia | AUD$50 / 0.1% |

| US | US$50 / 2 cents per share |

| UK | £40 / 0.1% |

| Germany | €50 / 0.1% |

| Ireland | €50 / 0.1% |

There is also an ongoing subscription fee charged to IG account holders of $50 per quarter (every three months). This fee applies to IG share trading accounts only, and not for CFD accounts. This subscription fee will be waived if you meet either of the below two conditions:

This subscription fee will be deducted from your cash account each quarter. If you do not have enough funds available in your cash account, your balance may go into negative.

Additional monthly fees may also apply if you wish to access live prices for Australian and international stock exchanges, but there is the potential to have these fees refunded if you place more than a specified number of trades each month. Contact IG directly for detailed information on these fees and charges.

To view live prices on Australian and international share markets, you will need to activate the relevant data feed through your IG share trading account. This will incur an ongoing fee in some circumstances.

While not exactly a fee, it's worth noting that there's no minimum balance requirement on your IG share trading account. You aren't required to deposit any money upfront in order to open the account, and there aren't any ongoing account balance limits you need to maintain to keep it.

You can fund your IG share trading account in a number of ways including credit card, debit or BPAY. Each method attracts different fees. If you're in Australia, the minimum deposit via credit or debit card is $450.

There is however, no minimum deposit amount if you're funding your account via bank transfer, BPAY or PayPal. Below is a list of methods for funding your account based on your location.

Note: IG does not accept payments made via commercial and business credit cards, or cash.

| Payment type | IG's cost | Execution time | How to pay |

|---|---|---|---|

| Credit card | Visa: 1% (AUD transactions) Mastercard: 0.5% (AUD transactions) Non-AUD transactions: 1.5% | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Debit card | Visa: Free Mastercard: Free | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| BPAY | Free | Up to two business days | Your BPAY Biller and Customer Reference number is available from the following locations:

|

| PayPal | 1% flat charge | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Payment type | IG's cost | Execution time | How to pay |

|---|---|---|---|

| Credit card | 1.5% | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Debit card | Visa: Free Mastercard: Free | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Electronic funds transfer to NZ based account | Free | Up to three business days | Account name: IG Markets Ltd Client Trust Bank / Branch Code: 03-0252 Account number: 0834546-05 Currency: NZD only |

| PayPal | 1% flat charge | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Payment type | IG's cost | Execution time | How to pay |

|---|---|---|---|

| Credit card | 1.5% | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Debit card | Visa: Free Mastercard: Free | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Local transfer to their HK based account | Free | Up to three business days | Bank Name: The Hongkong and Shanghai Banking Corporation Limited HSBC Main Building, 1 Queens Road Central, Hong Kong Account Name: IG Markets Ltd - Client Trust Account Swift Code: HSBCHKHHHKH Account Number(s): USD Currency - 848391785201 HKD Currency - 848391785001 AUD Currency - 848391785203 |

| International Transfer to their Australian based account | Free | Up to three business days | Bank Name: Westpac Banking Corporation 409 St Kilda Road Melbourne Vic 3004 Australia Account Name: IG Markets Client Trust Account Swift Code: WPACAU2SXXX Account Number(s): USD Currency - 034702372672 HKD Currency - 034734320199 AUD Currency - 033079189977 EUR Currency - 034705308262 GBP Currency - 034703392421 |

| PayPal | 1% flat charge | Instant | Login to the trading platform, select 'Payments' and follow the prompts. |

| Payment type | IG's cost | Execution time | How to pay |

|---|---|---|---|

| Credit card | 1.5% | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Debit card | Visa: Free Mastercard: Free | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Local transfer to their HK based account | Free | Up to three business days | Bank Name: The Hongkong and Shanghai Banking Corporation Limited HSBC Main Building, 1 Queens Road Central, Hong Kong Account Name: IG Markets Ltd - Client Trust Account Swift Code: HSBCHKHHHKH Account Number(s): USD Currency - 848391785201 HKD Currency - 848391785001 AUD Currency - 848391785203 |

| International transfer to their Australian based account | Free | Up to three business days | Bank Name: Westpac Banking Corporation 409 St Kilda Road Melbourne Vic 3004 Australia Account Name: IG Markets Client Trust Account Swift Code: WPACAU2SXXX Account Number(s): USD Currency - 034702372672 HKD Currency - 034734320199 AUD Currency - 033079189977 EUR Currency - 034705308262 GBP Currency - 034703392421 |

| PayPal | 1% flat charge | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Payment type | IG's cost | Execution time | How to pay |

|---|---|---|---|

| Credit card | 1.5% | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| Debit card | Visa: Free Mastercard: Free | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

| International transfer to their Australian based account | Free | Up to three business days | Bank Name: Westpac Banking Corporation 409 St Kilda Road Melbourne Vic 3004 Australia Account Name: IG Markets Client Trust Account Swift Code: WPACAU2SXXX Account Number(s): USD Currency - 034702372672 HKD Currency - 034734320199 AUD Currency - 033079189977 EUR Currency - 034705308262 GBP Currency - 034703392421 |

| PayPal | 1% flat charge | Instant | Log in to the trading platform, select 'Payments' and follow the prompts |

Source: IG

If you'd like to sign up for an IG Share Trading account, click one of the "Go to site" links on this page to be securely redirected to the IG share trading website. You can then open an account by filling out an online application.

It takes around 5-10 minutes to apply and you will need to provide:

Once the IG accounts team has approved your application, you will then be able to fund your account and begin trading shares.