We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

Finder's chance of approval indicates your likelihood of getting accepted for a credit product such as a loan or a credit card.

Finder calculates your chance of approval by comparing your credit profile to hundreds of thousands of Finder members' successful applications for credit. In some cases, if we don't have enough information to model your chance of approval for a lender, we work with that lender to do this calculation.

Your chance of approval is an indication of your likelihood of approval for a product, and it may help you narrow your choices. It's not a guarantee of approval.

Ultimately, the lender has the final say on whether you're approved or not.

Looking for a new credit card or loan can feel confusing and uncertain. Who wants to apply and then be rejected? Not only does it feel bad, but it can have long-lasting consequences.

When you apply for credit, the lender will conduct a hard enquiry on your credit report. Lenders do this to assess whether you're a responsible credit user, based on your credit history. It's one of the key steps in assessing whether you'll get the loan or credit card.

Making multiple applications in a short period of time looks bad on your credit report and can impact your future ability to get credit. While each lender applies different criteria, a lower credit score and multiple hard enquiries will generally reduce your chances of success. In Australia, each hard credit enquiry stays on your report for five years, whether your application is approved or not.

That's why it's critical that you understand your chances of being approved for a product before you apply.

This is where Finder's chance of approval feature can help.

How is your chance of approval calculated?

In most cases, your chance of approval is based on an advanced algorithmic matching of your credit profile to other Finder members who were approved for a given lender or product. If we don't have enough information to model your chance of approval for a lender, we work with that lender to create a model.

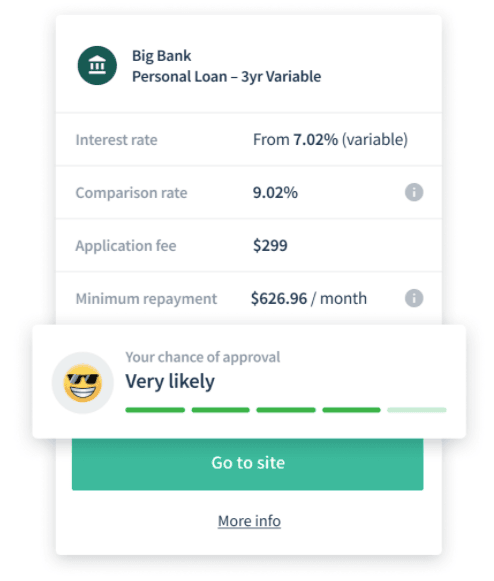

When you're logged in as a Finder member and are looking for a new loan or credit card, you might see your chance of approval rating, like this:

Your chance of approval can be:

- Very likely

- Likely

- Unlikely

- Very unlikely

- Not eligible: This means you don't meet the eligibility requirements for a specific product or lender.

- Not enough information: If we don't have enough data to assess your chance of approval, we'll show "Not enough information" under the product details.

Each Finder member has a different credit situation, so your chance of approval will likely be different to other Finder members for the same product or lender.

Ultimately, it's an indication, not a guarantee

When you apply for a new credit product, assessing your credit history is only one of the steps that lenders undertake. They also consider other factors, including your ability to repay the loan and any credit you already have.

So while your chance of approval is estimated by Finder (or in some cases, the lenders themselves) using a statistical model based on historical credit report data, it's not a perfect indicator of approval. That's why it's possible for you to get a "Very likely" indication for a loan or credit card, but still not be approved when you actually apply.

We understand that's frustrating, but it's important that you know that there's more to it.

What you can do if you're not approved

If you apply for a new card or a loan and get an unsuccessful outcome, be patient.

Even though there may be a short term effect on your credit score, it may be small and can be improved over time. Check out our guide on how to improve your credit score before you apply again.

The bottom line

Your chance of approval is an indication of your likelihood of getting accepted for a new loan or credit card.

While it's not a perfect indicator of approval, it can help you find credit products that are a good match for your credit profile. Ultimately, the lender has the final say in whether you're approved or not.

The best thing you can do is to keep your credit report in good shape by using credit responsibly, and check that you meet the lender's eligibility criteria before applying.