Do I need life insurance?

Take the 1 minute quiz and find out.

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

Most of us take out life insurance at one of four significant moments in life. These are either having kids, buying a house, changes to financial situations or getting married. If you're near any of these situations, there's a good chance you need life insurance. If you're still unsure, take our one-minute quiz below.

Quiz: Do you need life insurance?

When do most people take out life insurance?

Source: Deloitte

Is there a perfect age to get cover?

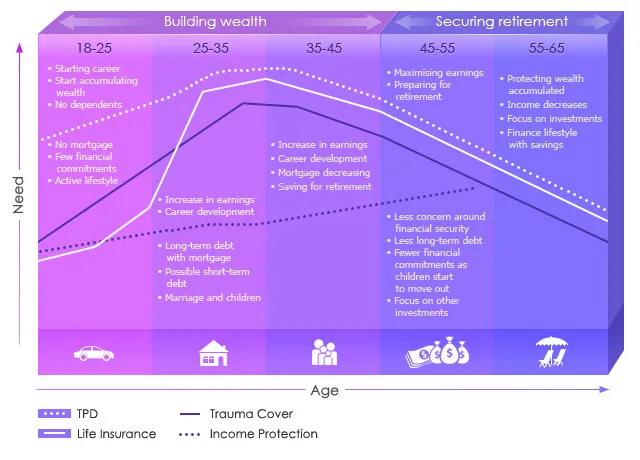

This will usually depend on your needs at the time e.g. the life events that occur during that age and the financial obligations you have.

| Age | Life events | Financial obligations | Types of insurance to consider |

|---|---|---|---|

| 18-25 |

|

|

|

| 25-35 |

|

|

|

| 35-45 |

|

|

|

| 45-55 |

|

|

|

| 55 and Over |

|

|

|

Based on where I'm at in life what type of cover do I need?

Everybody is different and cover requirements will change based on the events you encounter at different life stages. Its worth reviewing your life insurance every year to ensure you have enough cover in place. The graphic below gives an overview of key times to take out cover in different life stages.

Do you still need life insurance if you're retired?

It is natural for the need for life insurance to reduce once people enter their retirement years and their financial obligations change. You may wish to decrease the amount of cover you have in future years but still have some in place to:

- Provide a legacy to your surviving children in the event of your death

- Cover funeral expenses

- Tie up any final expenses such as legal fees or taxes

It is worth taking into consideration existing assets that may be used in the event of your death such as:

- Superannuation

- Savings

- Property

- Other assets such as car, contents

Do you need cover if you're young?

You may not require life cover at this stage but may want to consider funeral insurance to cover the cost of your funeral or TPD, Trauma or Income Protection to provide you with an income if you suffer a serious injury or illness.

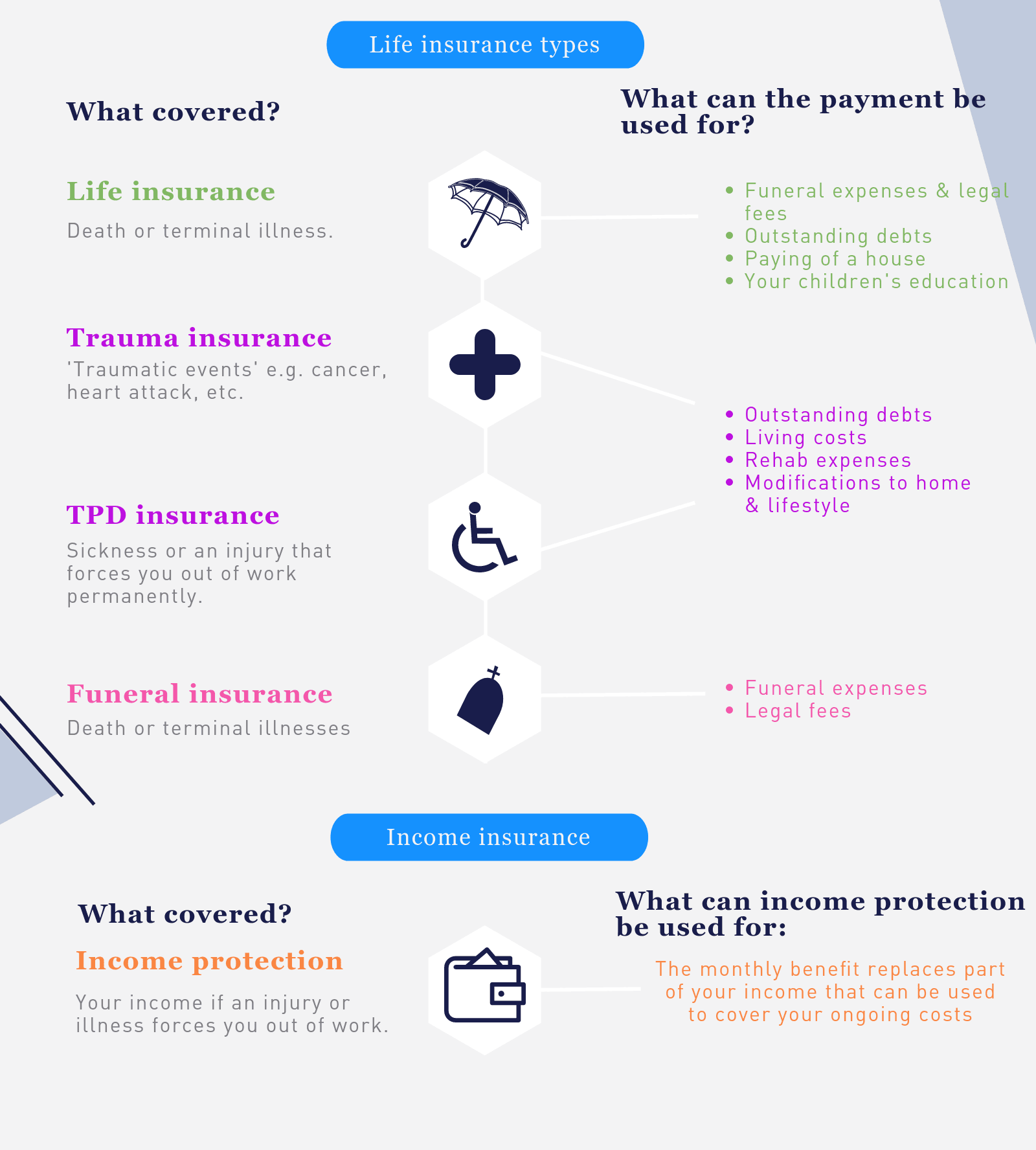

What types of life insurance are available in Australia?

It's a good idea to understand the main types of cover you can get:

- Life cover. Life insurance provides a lump sum benefit in the event of death or terminal illness.

- Income protection insurance. Income protection offers an ongoing benefit of 75% of the policyholders regular income if they are forced to take time off work due to illness or injury. This benefit is usually paid monthly.

- TPD insurance. Total permanent disability (TPD) insurance provides a lump sum benefit if the policyholder suffers a disability as defined in their policy.

- Trauma insurance. Provides a lump sum benefit if the insured suffers a medical trauma that is specified in their policy. Most policies will cover up to 50 different conditions including stroke, cancer and heart attack.

- Funeral insurance. Funeral insurance provides a lump sum benefit to cover funeral costs and other outstanding expenses. The maximum amount of cover that can be taken out is usually about $30,000.

Still unsure if you need cover? Ask yourself these questions

- No - They are dependant on my financial support

Everyone is different and will require different levels of cover. Get a more comprehensive understanding of your individual policy requirements by speaking to a qualified adviser.

- Yes - My loved ones will be just fine

- No - I will need additional financial support

There are many types of cover to protect yourself against financial pressure if you were no longer able to work due to a serious illness or injury. An insurance consultant can guide you through the process of identifying the type of cover you may require and help you tailor cover closer to your needs through additional benefits. The different types of "Living Insurance" are listed below:

Income Protection:

Will provide 75% of your income paid monthly if you are forced to take time out of work due to an illness or injury. Some policies will provide additional payments to cover rehabilitation expenses

Total & Permanent Disability (TPD) Cover:

Provides a lump sum benefit in the event you suffer total and permanent disablement as defined by your policy. The benefit is usually paid if a medical practitioner deems you are not capable of returning to your previous occupation

Trauma Cover:

Often purchased with life cover, trauma insurance will provide a lump-sum benefit if you suffer a serious medical condition such as stroke, cancer or heart attack. Some policies will cover up to 50 different conditions

- Yes - I have supplementary cover from other insurance policies to help me cope

While most Australian’s have some sort of cover in their Superannuation Fund, Health Insurance or WorkCover policy. What most people don’t know, is the default cover provided is usually only a portion of what they will actually require in the event of death, serious illness or injury (sometimes as little as 20%).

If you're not sure about whether the cover provided by your employer or super fund is enough, it may be worthwhile to find out exactly what you stand to receive in the event of a claim and comparing this to what you actually require. An insurance consultant can also help you review your policy.

Compare Life insurance quotes from these direct brands

An adviser can help you find cover from trusted life insurance brands.

- Get competitive quotes from multiple brands

- Lower rate of declined claims (according to ASIC)

- Save time and effort

More guides on Finder

-

Holiday home insurance

What to know about insurance before renting out your home, and what to look for in Airbnb insurance.

-

Health insurance for kidney dialysis

Dialysis treatment for Chronic Kidney Disease (CKD) is covered by Medicare and private health insurance, but which offers the best cover?

-

Health insurance for podiatry

Find out the steps needed to find adequate cover, and give you an assurance that you won’t have to pay the full cost of your podiatric surgery.

-

Buy sell insurance agreements

Learn how buy sell insurance actually works and organise cover with a consultant to protect your business and loved ones.

-

How much TPD insurance should I have?

Find out what exactly TPD insurance covers and how to determine an appropriate level of cover to give adequate protection in the event of disablement.

-

Big income protection changes just 2 weeks away: What you must do now

A number of major income protection changes are taking place on 1 October – here's how the new rules impact you.

-

Thinking of making a TPD claim? Learn the 5 key steps to take

If you need to make a claim on your TPD insurance, follow these steps to ensure you have the best chance of making a successful claim.

-

Travel insurance ombudsman

Your guide to how the Financial Ombudsman Service can help resolve disputes between you and your travel insurer.

-

Cancer health insurance in Australia

Health insurance for cancer improves on what Medicare covers by giving you more control and quicker treatment.

-

Health insurance for elective surgery

Australia has a great public healthcare system, but when it comes to elective surgery, there are good reasons to get private health insurance.

Ask an Expert