Debt consolidation loans

Reduce your interest rate, fees and monthly repayments with a debt consolidation loan.

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Compare up to 4 providers

- What is a debt consolidation loan and how does it work?

- Situations where a debt consolidation loan could help you

- Steps to consolidating your debts with a personal loan

- What are the dos and don'ts of debt consolidation loans?

- What should I consider when consolidating debt with a personal loan?

- How can I calculate if a debt consolidation loan is right for me?

- How can I get the most out of debt consolidation?

- What are the pros and cons of debt consolidation loans?

- What should I do before applying for a debt consolidation loan?

- What are the other debt consolidation methods available?

- Debt-reduction strategies

- How can I get a debt consolidation loan with bad credit?

- How can I compare bad credit debt consolidation loans?

- How can I apply for a debt consolidation loan?

- Frequently asked questions

You can combine your existing loans and debts into a single loan with a debt consolidation loan. This means you won't have to juggle multiple repayment terms. You also won't have to pay different rates for different loans.

While this sounds ideal, a debt consolidation loan is only helpful if it is cheaper than your current debt. The goal is to help you reduce your overall debt and make it easier to manage your money.

What is a debt consolidation loan and how does it work?

A debt consolidation loan is a personal loan taken out with the purpose of using the money to pay off your other debts.

If you have consumer debts from multiple sources, say several credit cards and a personal loan, then you'll have bills due on different days. The repayment amounts will also be different. You'll be managing multiple bills due at different times and that can get overwhelming.

You could even miss a payment because it's difficult to keep track of when the payments are due. You could also miss a payment because you're having financial difficulties and cannot meet your repayments on time.

Whatever the reason, a debt consolidation loan will allow you to roll all your debts into a single loan.

With the loan funds, you can pay off your other debts and maintain a single credit account. You won't be debt-free just yet, but you won't have multiple debts hanging over you either. You'll have a set repayment date, a single set of repayments to make and a single interest rate.

With just one debt payment to make, it will be easier for you to manage, track and make your repayments. It can give you greater control over your finances, and you will have a clearer timeline of when you will be debt-free.

While a debt consolidation loan may sound like a perfect solution, it can only help you if it costs less than all your other loans combined. You may have the ease of a single recurring repayment, but your financial burden will not be eased if it costs more.

In your calculations, you should factor in not only the overall cost of the loan but also the cost associated with exiting other loan contracts.

Situations where a debt consolidation loan could help you

Here's when a debt consolidation loan can be helpful:

- You have multiple debts with different fees. These could include debts from credit cards, personal loans, car loans or student loans.

- You're struggling to make repayments for the different debts you owe.

- You're looking for a cheaper way to pay off your debts.

- You find that keeping track of all your debts is confusing and/or overwhelming.

Steps to consolidating your debts with a personal loan

- Work out how much you need to borrow to cover your debts. Here's how:

- a) First, make a list of all your debts. You can do this by checking your credit report for free here. This will include details of the credit products you hold as well as your credit inquiries, defaults and repayment history. Alternatively, you could also sign into your online accounts to retrieve your current account balance.

- b) Write down how much you owe, matching the debt with the total amount due. If you have credit card debt, write down the outstanding amount. The same goes for your other debts.

- c) Check with the service provider if there is an early exit fee. Some personal loans, for example, come with break fees.

- d) Add the amount owed plus any exit fees to calculate how much you owe in total.

- e) Calculate how much interest you will pay with your current debts. Compare this to the total interest you'll pay with the new loan.

- f) Before you take out a debt consolidation loan, you should look into whether you can manage without the loan.

If you have the means to pay off your debts without taking out another loan, you should consider that first.

It doesn't have to be all the debt, but any small debt you can pay off without a loan should be settled. This way, the total amount you have to borrow is reduced, so you'll have less debt.

- Work out how much you need to borrow to cover your debts. Subtract any debt you've settled with your own funds. Include any fees and charges you will have to pay to exit the remaining loans early.

- Research and compare personal loan products to find one that meets your needs. Personal loans are usually suited for debt amounts from $8,000 up to $50,000.

- Compare your total debt with the debt you'll be incurring with the new personal loan.Does it cost more to take out a new personal loan? If yes, do not proceed with taking out the loan. Talk to a financial adviser instead to work out strategies on how to manage your existing debt.

- If it's cheaper for you to take out a new personal loan and consolidate your debt, then you can apply for the personal loan. Make sure you check the eligibility criteria to see if you meet them.

- Use the funds to pay off your other debts, along with any fees or charges.

- Continue to make repayments on your personal loan until it has been repaid. There are other methods you can use to consolidate debt. This can include using a credit card. You can read our comprehensive guide to debt consolidation here.

What are the dos and don'ts of debt consolidation loans?

Dos

- Factor in all the costs of consolidating your debt.

This includes fees for the new loan. Include establishment fees, monthly fees, early repayment fees, loan application fees and any other costs.

Use a personal loan calculator to work out how much you'll be paying and make sure the cost of consolidating is less than what you're currently paying.

- Consider a secured loan.

The interest rate for an unsecured loan is higher than that of a secured loan. By offering an asset (like your car) as security, you could get a lower interest rate. This could potentially save you more money over the life of your loan.

- Speak to your current lenders first.

Try negotiating with your current lenders to factor in your financial situation. See if they can temporarily pause or lower your loan payments.

- Read the fine print.

As with any loan, you should read the fine print. This will help you understand specific details, such as your repayment schedule (monthly or fortnightly repayments) and whether you can make extra repayments without being penalised.

Don'ts

- Don't switch to a longer term without calculating the cost.

You may have lower monthly repayments, but the overall cost of the loan could be higher. This is because you'll be paying interest for longer. Account for this cost in your calculations if you're looking at a longer term loan.

- Don't forget to check if your new credit provider is credible.

Always make sure the lender is registered with ASIC. You can do this by checking if the lender is listed on ASIC's Professional Registers.Be wary of companies that try to rush through the process, make unrealistic promises or ask you to sign blank documents.

- Avoid rolling your debts into your mortgage.

Home loans generally have longer terms. Adding your debts into your mortgage could lead to paying more interest over the life of your loan. This means a potentially costlier, long-term debt.

- Don't get into more debt.

You should stop relying on credit cards or other loans until your existing debts are settled. The more money you can put towards making your repayments, the faster you can get out of debt.

What should I consider when consolidating debt with a personal loan?

- Is it cheaper? This is probably the main point for getting a debt consolidation loan in the first place. Don't forget to check the interest rate, all the fees and loan terms.

- Will it help me manage my existing debt? Does this loan allow you to take care of those other pesky debts or are you still saddled with them?

- Will it help me improve my credit score? If you're behind on your repayments, your credit score could be affected. Is your new loan less than the total credit available to you? If you're using less than the total credit available to you, your score can improve.

- Will it help me get out of debt faster? You should be looking at not only getting out of debt, but also getting out of debt faster. A loan with longer terms may be cheaper, but it will prolong the time you're in debt.

- Can I afford it? You need to be able to afford the new loan. Calculate whether you'll have difficulty paying off the loan even after your other debts have been paid off. See how it fits in with your current budget. Are you still out of pocket? Is it a tight fit?

- How will I pay it off? Will you be paying weekly, fortnightly or monthly? Is the payment schedule in line with your pay cheque? If it's out of sync, you might want to look for a loan that allows you the flexibility to schedule the payment according to your pay schedule.

How can I calculate if a debt consolidation loan is right for me?

Case study: Laura's debt consolidation calculation

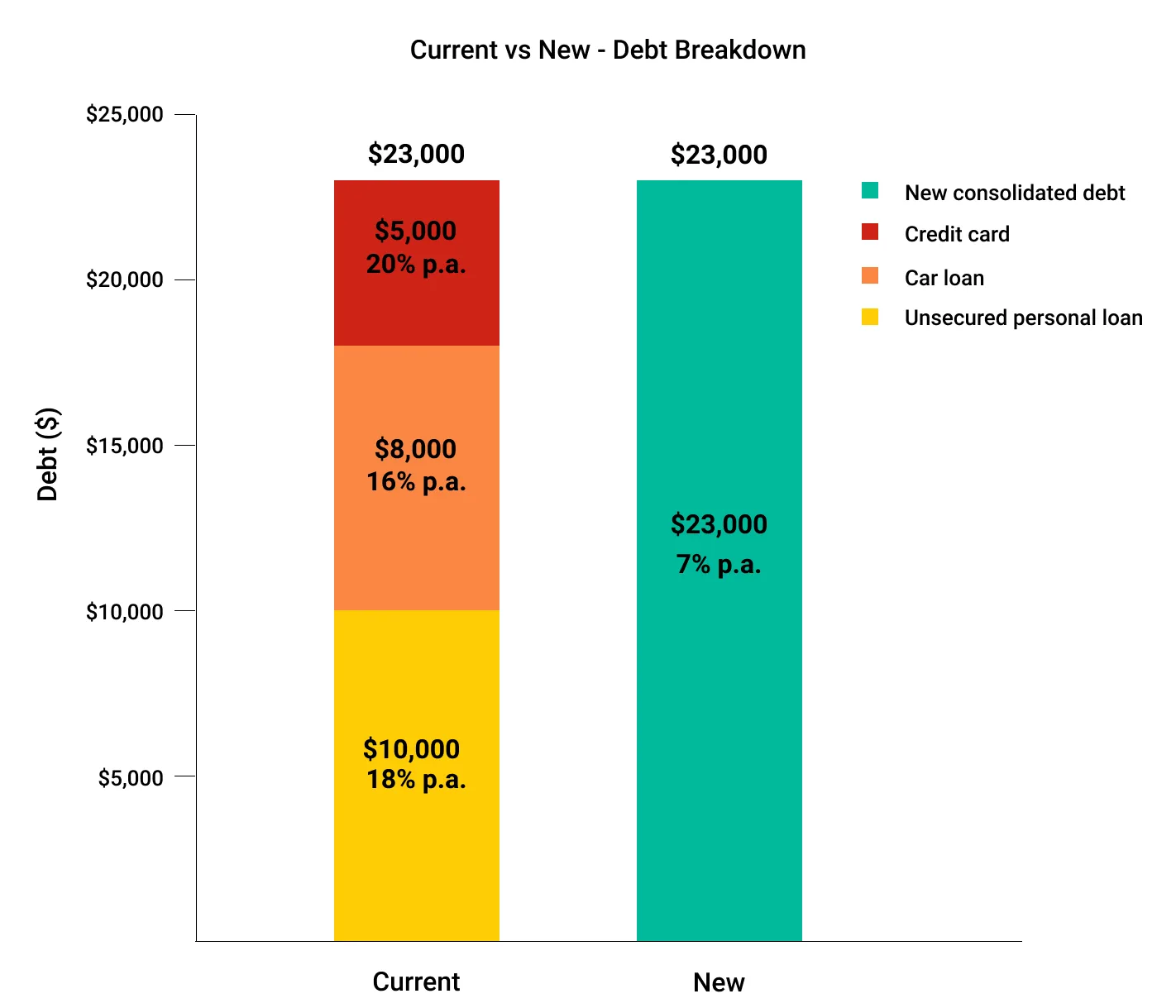

Laura has $23,000 in total debt. Her debt includes the following amounts left to pay:

- Unsecured personal loan - $10,000 at 18% p.a.

- Car loan - $8,000 at 16% p.a.

- Credit card loan - $5,000 at 20% p.a.

If Laura takes out a debt consolidation loan, her total debt remains the same.

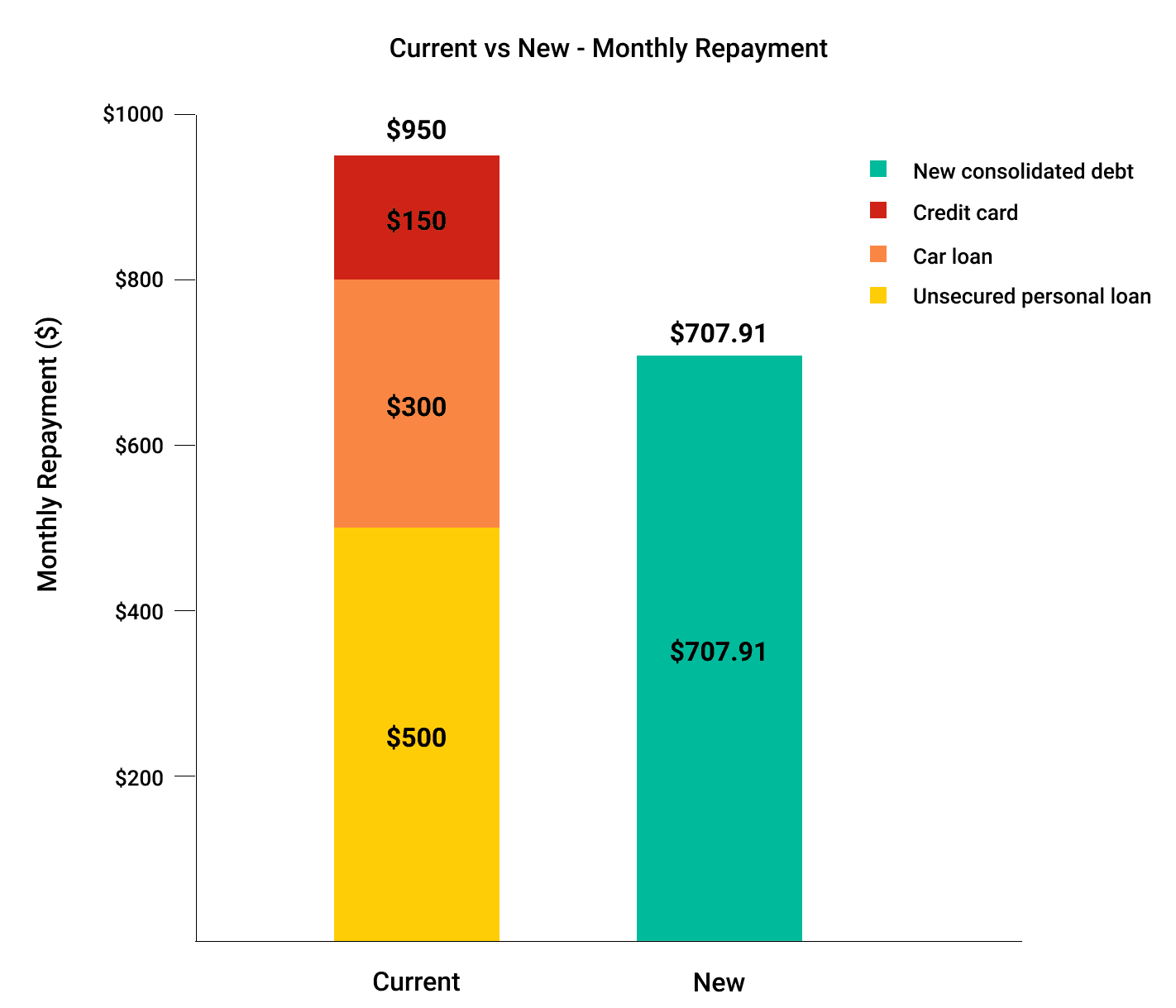

However, the difference lies in how much Laura pays for her new loan every month. Her current repayments come up to a total of $950 per month while her new monthly repayments will be $707.91 per month.

With the debt consolidation loan, Laura's monthly repayments will be reduced by $242.09 per month because the overall interest for her new loan is less than that of her current loans. She will save $3,142* overall over the 3-year loan term

Laura also knows she will be out of debt in 3 years and she only has to manage 1 repayment per month.

*Assuming there are no penalty charges for repaying loans early.

How can I get the most out of debt consolidation?

- Set a budget to manage repayments and stick to it. Don't forget to include your repayments in your budget. All your bills and repayments should get priority.

- Set up reminders or a direct debit option for your repayments. This way, you're less likely to forget. Make sure you have enough money in your account for direct debits.

- Make extra repayments to pay off your debt sooner. If you can manage it, look into making extra repayments. Check if your lender charges fees for extra repayments first.

- Get on and stay on top of your finances. Finder has a financial bootcamp that could help you get financially fit.

- Look for ways to cut down on expenditure. Identify your needs from your wants and prioritise expenses. Hunker down if you have to.

- Work on improving your credit score. Pay all your bills on time. Making repayments on time can improve your credit score.

- Don't take on any more debt. You want to take care of your existing debt first so that you don't run into financial difficulties again. The good news is that with good financial habits, your score will improve. This means that you're more likely to get better rates in the future.

- Look for financial management tools to help you keep track of your debt. There are many budgeting tools that can help make budgeting easier. The Finder App is free and can help you track and manage all your accounts and money. This includes all your loans and credit cards. We've also listed other budgeting apps that can help.

What are the pros and cons of debt consolidation loans?

Pros

- Simple, single repayment.

- You can reduce your overall payments and costs.

- No more phone calls from debt collectors.

Cons

- It is yet another loan to manage.

- You will need to pay any fees or charges for breaking your existing loans.

- You may increase your financial burden if you fail to make repayments.

What should I do before applying for a debt consolidation loan?

- The very first thing you should do is check your other options first. Talk to your credit providers and renegotiate your current loans. Ask them if they can change your repayments or extend your loan. This is called hardship variation. All lenders have such programs to help out during financial crises.If you have overdue bills, talk to your service providers and see if you can work something out.

- Settle what you can. Try your best to settle what you can with your own money. Borrowing money comes at a cost. If you're able to take care of smaller debts on your own, try to do so. That way you won't be paying interest for money you don't need to borrow.

- If you've decided to take out a debt consolidation loan, compare your options. Comparing loan options helps you find the best deal, not only in terms of price but also features and functionality. If you want a loan with certain features, for example, early repayments without penalty, comparing loans can help you find a loan that has what you want.

- Always check if you're eligible to apply. If you find the ideal loan, but find that you're not eligible, do not apply for the loan. Every loan application is listed on your report, and every hard credit check takes you down a few notches. Every loan rejection also affects your credit report mark. Only apply for a loan if you're certain you meet its eligibility criteria.

- Don't apply for too many loans in a short period. If you've made a shortlist of lenders, select the lender you have the best shot with. Too many loan applications in a short period of time will affect your credit score.

What are the other debt consolidation methods available?

Debt consolidation loans are not the only type of credit if you're struggling with debt. Based on your needs and the type of debt you have, you could also look into the following options. However, you should carefully consider the consequences of any of these options.

- Balance transfer credit cards. If you have credit card debt across multiple accounts, you could consolidate it into a single card with a balance transfer. You will pay 0% interest for a specific period of time. Some card providers offer up to 24 months interest-free. However, if you fail to pay your debt during the interest-free period, you may end up paying higher interest after this period. Certain credit card providers also let you balance transfer personal loan debt to a credit card. You will need good credit to be approved for this. Keep in mind that every credit enquiry recorded on your credit file will affect your score.

- Part 9 Debt Agreements. If you're having trouble paying your debt, you could enter into a debt agreement with a third-party organisation and your creditors. The agreement essentially freezes the interest you're paying and gives you a certain repayment period to pay back what you owe. Some creditors agree to accept less than the full balance for repaying your debt. However, this method shouldn't be entered into lightly. It is considered a form of bankruptcy and has long-term repercussions. It will be listed on your credit report for 5 years and can result in you having difficulty accessing credit in the future.

- Credit counselling. You can enlist the services of a reputable credit counselling organisation to formulate a Debt Management Plan (DMP). Once you enrol in a DMP, the creditors will often reduce your interest rates. Afterwards, you will need to make 1 monthly payment to the counselling organisation. This organisation will handle the repayment to your creditors. This is an option if you can repay your debt within 5 years, but it isn't a decision that should be taken lightly. This should only be entered into if you're having difficulty repaying your debts on your own. There are also fees to consider, and depending on the solution offered, your credit could take a hit.

Staying out of debt

When it comes to staying out of debt, there are a few strategies you can take.

You could look into developing an emergency fund by trying to save up to 15% of your income. If you find this number high, or just want a way to ease the financial strain, you could consider creating alternate sources of income, such as freelancing.

You could also consider selling some of your unused items or finding ways to cut back on your expenses.

As always, creating a budget and sticking to it is a sure-fire way to keep you on track.

Adding to your savings can also help you in the long run.

Debt-reduction strategies

If you're considering tackling debt without taking out more credit, there are ways you can take control of your finances. We've outlined 4 debt-reduction strategies you could consider. Their suitability will depend on your circumstances and what you're comfortable doing.

- The "snowball" or "domino" method. The "snowball" or "domino" method involves you paying off the smallest balance first. You then gradually proceed to the larger amounts due, irrespective of interest rates. This method helps get more accounts closed quickly, saving you interest and fees. It also gets you motivated as your debt is being incrementally paid off.

To do this, you should do the following:

- Write down your total outstanding debts. This involves making a list of your total outstanding debts on each of your credit accounts. Set aside your mortgage and HECS-HELP debt. You don't need to consider interest rates at this point.

- Check early exit penalties. Consider early repayment fees for your personal loans. Contact your lender if you have any concerns about repaying your loans early.

- Start by paying off your smallest debt. Whichever account has the smallest balance is the account you make additional payments into and pay off first.

- And so on. Once you've repaid your smallest debt, start to make additional payments to the second smallest balance, and so on, until you're out of debt.

- Similar sized balances. If two accounts have similar balances, pay off the higher interest rate account first.

- Keep making your minimum repayments. Remember to keep paying the minimum balance on all accounts.

- Pay off your highest interest balances first. Another strategy is to pay your highest interest balances first. Paying off these accounts will save you money on interest repayments. It will have the same benefit as the "snowball" method in that it will help close your accounts.

To do this, you should do the following:

- Write down all the outstanding debts. Start by writing down all your accounts, the balance outstanding on each and the interest rates.

- Start making additional repayments. Take into account the interest lenders are charging. Remember to consider the balance of credit accounts when you start paying them down.

- Keep paying your minimum. Remember to keep making minimum repayments on all accounts.

- Save money where possible.

Finding the money to make additional payments can be a struggle. Luckily, there are a number of ways you can save money by making just small changes to your lifestyle. These include the following:

- Upgrading your savings account. When was the last time you compared your savings accounts? You may be able to find an account with a better interest rate than your current savings account. This could make your money go further.

- Utilising coupons. Before making a purchase, have you checked if you could get it cheaper with a coupon code?

- Put aside whatever you can. Save where you can. Putting all your additional funds into your prioritised debt (according to the strategy you've adopted) is key to being debt-free.

- Budget, budget, budget.

Developing and sticking to a budget is of paramount importance when it comes to getting out of debt. There are a number of budgeting websites, tools and apps that can help you do the following:

- Invest

- Track your spending

- Manage your invoices

- Manage your bills and expenses

- Round up your money to the nearest dollar to add to a savings account.

How can I get a debt consolidation loan with bad credit?

There are a few ways you can consolidate your debt if you have bad credit:

- Apply for an unsecured personal loan with a specialist lender. Some lenders offer large, unsecured personal loans for people with bad credit. Interest rates are higher than with standard personal loans, but you may still be able to reduce what you're currently paying.

- Consider a Part 9 Debt Agreement. Debt Agreements are a form of bankruptcy. It is an option for people with large debts they are unable to repay. The financier will negotiate with lenders on behalf of you, and your debts won't accrue more interest. However, this agreement will be listed on your credit file for 5 years from the date you enter into it, which can have long-term consequences for your credit score.

How can I compare bad credit debt consolidation loans?

Like any debt or loan solution, it's important to compare your options to find the best solution possible. Here are some things to keep in mind when comparing bad credit debt consolidation loans:

- The lender needs to be reputable. Unfortunately, there are disreputable lenders who prey on those with bad credit. They promise loans but charge high rates and fees. Before submitting an application for a loan, you should look at the lender's website and note how easy it is to locate information. Check if the lender is easily contactable and even read some third-party customer reviews online. You should also check if they're registered with ASIC.

- Fees are expected, but they shouldn't be excessive. To find out how fair the fee structure is, compare options online and look at what other lenders are charging. Some common fees include loan establishment fees, monthly account-keeping fees, additional repayment fees, default fees and dishonour fees. You should also check if there are fees for using certain features, such as fees for additional repayments or redraw facilities.

- Rates need to be reasonable. The point of a debt consolidation loan is to save money through reduced interest. If the rate charged is too high, there may be no savings, and you could even end up worse off. You should compare your options to gauge what a reasonable, competitive interest rate is.

- Loan terms should meet your debt consolidation needs. The terms will affect how much your repayments are as well as how much interest you will be paying over the course of the loan.

- What you're able to consolidate may differ between lenders. Some lenders may allow you to consolidate any debts from open accounts, but there may be limits. Other lenders may only allow you to consolidate credit card debt or only personal loan debt. You should make sure you'll be able to consolidate what you need when comparing your options.

How can I apply for a debt consolidation loan?

👁 To apply for a debt consolidation loan, you should first compare lenders. Look at the fees, terms and eligibility criteria and find a loan that suits you.

🔍 Once you've settled on a lender from the table above, click "Go to site" to visit the lender's website.

✍ You can submit an online application. Keep all the documents required handy. This will speed up the process.

Frequently asked questions

Some lenders class Centrelink as income you can use to service your loan. It's important to find out if your lender accepts Centrelink recipients. If you're on Newstart or Youth Allowance, you may need to speak to your creditors and work out a repayment plan.

Most major banks offer debt consolidation loans. There are also alternative lenders, like online banks and peer-to-peer lenders. Credit unions may offer debt consolidation loans too. You should shop around to find one that works best for you.

There are definite advantages to applying with your current bank. It may be more willing to approve you as you have an existing relationship with it. It also has a clear idea of your incomings and outgoings. At the same time, it may not offer the best deal. You may want to compare your options to work out how competitive its products are. You should then talk to your bank before applying to discuss your eligibility.

If your application gets rejected, you should allow for a cooling-off period. Making too many applications in a short period will result in many hard credit checks. This can affect your credit score. You should take some time to improve your score and give yourself several months before applying. By improving your score, you can increase your chances of getting credit.

It may be worth considering if you have a large amount of debt to consolidate or if you believe it is the most cost-effective option. You can read our guide to refinancing your home to consolidate debt for more information.

You can read our guide on improving your credit score here. The good news is that your score gets updated every month. This means that the steps you take to improve it now will pay off sooner rather than later.

Yes, you can roll all your credit cards into a new consolidated loan. If you have one card with a $6,400 limit at 19.99% p.a., another with a $1,000 limit at 13.49% p.a. and an "interest-free" store card, you can consolidate them into a new loan.

This will depend not only on the lender but also on your credit score. Most lenders now advertise rates starting from a particular percentage. The better your credit score, the lower your rate. If your score is middling, you can expect a higher rate. You can check the table above for a comparison of interest rates.

The eligibility criteria vary between lenders. You may find it easier to qualify with some lenders and for some loans than others. It will also depend on your credit history. A secured loan, for instance, is less risky for lenders as there is security attached. If your credit history isn't great, you may have a better chance of getting a secured loan than an unsecured loan.

This will depend entirely on the lender. Some lenders offer quick applications and quick approvals. They may respond within minutes or hours of submitting your application.

A debt consolidation loan is a standard personal loan product that allows you to consolidate your current debts into one debt. A debt agreement is usually taken out by people with large debts and bad credit histories. It is a form of bankruptcy. Make sure you look into the terms of the loan and the effect it will have on your credit file.

Elizabeth Barry is Finder's global fintech editor. She has written about finance for over six years and has been featured in a range of publications and media including Seven News, the ABC, Mamamia, Dynamic Business and Financy. Elizabeth has a Bachelor of Communications and a Master of Creative Writing from the University of Technology Sydney. In 2017, she received the Highly Commended award for Best New Journalist at the IT Journalism Awards. Elizabeth's passion is writing about innovations in financial services (which has surprised her more than anyone else).

More guides on Finder

- Salt and Lime Debt Consolidation Loan

Looking to consolidate your debt? Salt and Lime offers fee-free loans, same-day funding, and the ability to earn discounts on your interest over the life of the loan. Apply today.

- Insolvency vs bankruptcy

Want to understand the differences between personal insolvency and bankruptcy, and what both of these terms mean for your financial future? Find out here.

- What are the consequences of bankruptcy?

This guide will take you through the consequences of bankruptcy so you can decide if it's the right option for you.

- Debt solutions

Need a solution for your debt? Find out what options you have in this guide.

- Debt negotiation

What is debt negotiation and how can it help you? Find out here.

- What you’re doing wrong that keeps you in debt

It doesn't matter how long you've been in debt or how much debt you have, there are strategies you can use to free yourself from any kind of debt trap. Use our guide to see how you can set yourself on the road to regaining financial control, and getting out of debt once and for all.

- The best way to pay down $50,000 in debt

Debt can creep up on you, so what do you do when it hits $50,000? We talk to financial experts Noel Whittaker and Robert Dawson about the best strategies to pay down substantial debt.

- ANZ debt consolidation using a balance transfer or personal loan

Consolidate your debts into one account and repay your balance at a low interest rate with a personal loan or balance transfer credit card with ANZ.

Personal Loan Offers

Important Information*

Harmoney Unsecured Personal Loan

You'll receive a fixed rate between 5.35% p.a. and based on your risk profile.

Apply for a loan up to $50,000 and repay your loan over 3 or 5 years terms.

ANZ Fixed Rate Personal Loan

You'll receive a fixed rate of 8.99% p.a.

Apply for up to $50,000 to use for a variety of purposes without needing to add security. Available to self-employed applicants.

NAB Personal Loan Unsecured Fixed

You'll receive a fixed rate between 6.99% p.a. and 18.99% p.a. ( 7.91% p.a. to 19.83% p.a. comparison rate) based on your risk profile

Borrow from $5,000 to $55,000, with 1 years to 7 years loan terms available. This loan comes with no fees for extra repayments and no early exit fees.

SocietyOne Unsecured Personal Loan

You'll receive a fixed rate between 5.95% p.a. and 19.99% p.a. based on your risk profile

A loan from $5,000 to use for a range of purposes. Benefit from no ongoing fees and no early repayment fee.

I have loans that are overdue and outstanding balances to pay. I have the capacity to repay a loan up to $60,000. Where can I find a lender that will consolidate debts that are already overdue and next to being referred to CRAA?

Hi Allen,

Thank you for getting in touch with Finder.

You may refer to the table above with a list of debt consolidation loans. Banks/lenders also check your capability to repay the loan so it would be helpful for you to contact your chosen bank/lender directly regarding your loan needs.

You may also refer to our guide on bad credit debt consolidation.

I hope this helps.

Thank you and have a wonderful day!

Cheers,

Jeni

I have been approved for a consolidation loan but the interest is 18% over 5yrs. Short term it will be great to have 1 repayment but over the 5yrs the amount owing is crazy. Can I shop around for a better interest rate? Will it effect me in any way ie.credit checking?

Hi Nicole,

Thank you for leaving a question.

Yes, this is definitely an options available for you. You may still shop around for better deals but please note that each time you apply hits your credit score since an inquiry is being made. It is best to make sure that you want the deal before you apply for it. This ensures that you make as less inquiries on your credit score as possible. Hope this helps!

Cheers,

Reggie

I’ve been offered a debt consolidation loan but the interest is 17%. Do I have to keep applying to find a lender with lower rate? If I do start shopping for a better offer will it effect me in any way ie.credit checking?

Hi Nicole,

Thank you for leaving a question.

You do not need to keep on applying for a better deal but instead you may ask around on what other lenders could offer. The only time your credit score is when you are already applying for the loan. Speak with lender representatives and see what they could offer, if you do find a better deal then ask what the requirements are and see if you qualify before you apply for the loan. Hope this helps!

Cheers,

Reggie

I have $30,000 to consolidate. Looking for a way to consolidate with a fixed interest rate between 9% – 12%

Hi Jodie,

Thanks for your message and for visiting Finder.

The NOW Finance unsecured personal loan and the NAB unsecured loan has a fixed interest rate from 9-12%

Alternatively, The information above shows you multiple providers for debt consolidation. Please use our comparison table to help narrow down your options. Simply, enter the amount to be consolidated and sort the table based on interest rate p.a. to show you the providers within a 9%-12% fixed interest rate.

Once you have chosen a particular lender, you may then click on the “Go to site” button and you will be redirected to the lender’s website where you can proceed with your loan application or get in touch with their representatives for further assistance. Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Hope this helps! Feel free to message us anytime should you have further questions.

Cheers,

Nikki

I need to consolidate some loans and credit cards to the value of $97,000 – my bank only offers up to $50,000 – what do you suggest?

Hi Louise,

If your bank only offers up to $50,000 it could be better to consider applying for a new balance transfer offer with a higher credit limit or a personal loan for debt consolidation.

You may open the links above to compare your options. These pages have a comparison table you can use to see which provider suits you. When you are ready, you may then click on the “Go to site” button and you will be redirected to the lender’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Thanks,

Jonathan