Our top pick for

US stocks

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

These days you don't need to be sitting at a desk to buy and sell stocks. Thanks to the rise in share trading apps, you can make trades anywhere there's an internet connection from the palm of your hand.

Share trading apps let you trade shares on the ASX and other international markets through your smartphone. It's worth noting that not all online brokers have a mobile version of their platform and some mobile trading apps don't offer desktop access. So to make it easier, we've sourced a list of mobile stock trading apps available in Australia in 2021.

Our top pick for

US stocks

Our top pick for

ETF investing

Our top pick for

Overall broker

There's no single share trading app that's best for everyone as all our needs are different - and what's best for you might not be best for someone else. Keep in mind that we don't compare every product in the market, but we hope that our tools and information will allow you to compare your options and find the best share trading app for you.

The list of apps featured below are the nine most popular share trading apps in terms of daily downloads by Australian iPhone users as of March 11, 2021. The list itself was sourced by SensorTower and is not in any particular order.

To check out a list of Finder's highest rated share trading platforms as ranked using our proprietary algorithm, head to our Best Online Broker guide.

This trading app offers all the functionality of the CMC Markets full website on your mobile device. You can buy and sell shares from your mobile using all order types, including conditional and linked orders. The app also lets you view your current positions and order history, access market depth and up-to-date charts, and view your watchlists and portfolios.

CMC Markets' mobile platform also provides the latest market news and commentary and is available on iPhone and Android devices.

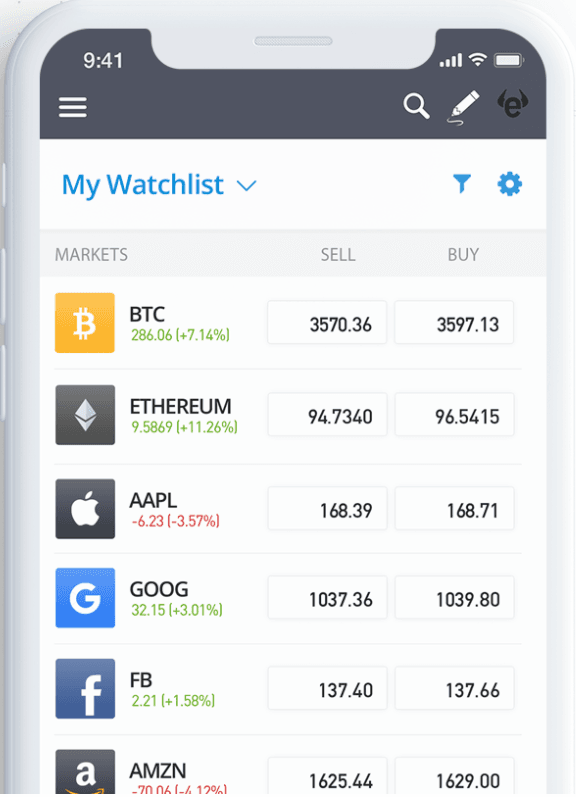

IG offers a suite of trading apps designed to give you the best mobile trading experience across a range of devices. There are separate apps optimised for use on each of the following devices: iPhone, Android mobile, Windows phone, iPad, Android tablet and Windows tablet.

eToro's popular trading app is designed for both desktop and mobile (Android and iPhone). It's well known for its copy trading feature that allows you to imitate the trades of top users or copy a portfolio of stocks selected by eToro.

The platform offers zero brokerage US, European and Hong Kong shares, as well as CFDs, forex and cryptocurrency trading.

Superhero's mobile app jumped straight onto the charts after it launched in early 2021 thanks to its ultra low costs and user friendly interface.

The platform offers US shares for $0 brokerage, Australian shares for a flat $5 brokerage and ETFs for $0 brokerage, plus no monthly fees. One of its big highlights is that you can invest as little as $100 into an Australian company, where normally you need a $500 minimum investment.

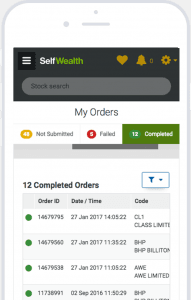

SelfWealth has one of the lowest brokerage fees on the market with a flat fee of $9.50 per trade, regardless of the trade size or how often you invest. The app can be access via desktop, Windows tablet, Android Tablet and any smartphone. The app is free and there are no inactivity or monthly fees for the basic account.

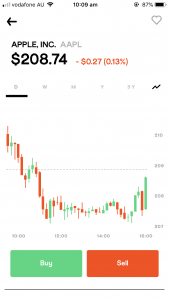

Stake allows you to cheaply and easily access stocks that are listed in the US with $0 brokerage fee. It offers access to thousands of US-listed stocks and ETFs, such as Google, Facebook and Alibaba. Instead of charging a brokerage fee, you're charged a fee to exchange your Australian Dollars into US Dollars.

The CommSec app allows you to access the CommSec share trading platform through your iPhone, iPad or Android smartphone. The app allows you to buy and sell shares, view and trade on live prices, and create watchlists to monitor company performance.

Designed for both Android and iPhone devices, nabtrade IRESS mobile is a share trading-specific app available to customers with a nabtrade account. The app allows you to buy or sell shares from your smartphone, including the ability to place contingent orders, access live prices, market depth and charts.

You can also view your Trading Account holdings, view your orders and order status, see the top ASX gainers and losers, and access customisable charts.

The Westpac Online Investing app is designed for iPhone, iPad and Android users and is optimised for use on smartphones. The trading-specific app allows you to trade shares, warrants, exchange traded funds (ETFs) and exchange traded commodities (ETCs).

You can use the app to create editable watchlists, view live quotes and news, view all your holdings and set up a wide range of customised alerts.

Standard brokerage - US shares

Get $0 brokerage on US, Hong Kong and European stocks with trades as little as $50 when you join the world's biggest social trading network.

Important: Share trading carries risk of capital loss.

Disclaimer: Trading CFDs and forex on leverage is high-risk and losses could exceed your deposits.

Important: Share trading can be financially risky and the value of your investment can go down as well as up. Standard brokerage is the cost to purchase $1,000 or less of equities without any qualifications or special eligibility. Where both CHESS sponsored and custodian shares are offered, we display the cheapest option.

In the wake of record low interest rates, Australians are moving money out of savings accounts and into other investments.

We compare Stake's new feature to other low-cost brokers in the market.

Superhero Super offers two different investment options which both give members more control over how their super is invested. Here's how the super account works.

We look at the pros and cons for those hoping to invest in gold bullion and other precious metals with Perth Mint.

If you’re thinking of trading stocks with Tiger Brokers, check out our review of this online broker’s fees, safety, and pros and cons first.

What you need to know about investing in OnlyFans from Australia.

Crypto portfolio trackers are a must to stay on top of your crypto investments. Here’s our list of the standout trackers to consider with pros and cons for each.

SPONSORED: Here are 5 simple tips to help you gain exposure to a wide range of investment opportunities on European stock markets.

Which app is the best for trading shares in Australia? What app lets me choose my own bank to withdraw funds from and cheaper broker fee?

Hello Rod,

Please note that we are unable to suggest personalized recommendation as to which trading share app is the best for you as each app has their own functionalities and each user has their own preferences. You may read forums and reviews instead on the most helpful trade sharing app people have been using.

Our page discusses a comprehensive guide you may refer to in choosing a share trading app and it also has some reviews on the available mobile trading apps you can choose from. Kindly go through this page to review the pros and cons of some apps.

— CommSec app

— nabtrade IRESS mobile

— Westpac Online Investing

— CMC Markets Stockbroking Mobile Platform

— Bell Direct Mobile App

— IG trading app

— HSBC Online Share Trading

Additionally, you may check the reviews on play store or app store for each app to see their users’ feedback.

Hope this helps!

All the best,

Ron