Annual Travel Insurance

Will you be travelling more than 3 times this year? Get annual travel insurance for multiple trips. It’s cheaper than buying single policies.

We’re reader-supported and may be paid when you visit links to partner sites. We don’t compare all products in the market, but we’re working on it!

Important:

Travel insurance rules continue to change as a result of the pandemic. Some information may not be accurate at this time. It’s even more important to double-check all details that matter to you before taking out cover. Please note:- Some policies may not be available through Finder at this time

- It’s unlikely that your policy will cover expenses from border closures

What is annual travel insurance?

Annual travel insurance is a type of policy that can cover you for multiple trips within a 12 month period. It's also known as a multi-trip policy. Annual travel insurance shouldn't be mistaken for long term travel insurance which gives you cover if your travelling continuously for +6 months without returning home.

A multi-trip policy is different to a single trip policy because you can travel as many times as you want but trip durations are typically capped off at 90 days. This can vary across different brands.

3 benefits of annual travel insurance

- Cheaper than buying single trip policies. An annual policy can usually save you money if you're taking three or more trips per year but depending on where you are going, it's possible to save even if you only travel twice.

- Time saver. You don't have to fill out new forms for every new trip. If you get a worldwide policy, you can be covered for domestic trips too.

- Automatic coverage. Have one less thing to think about when you're preparing for your trip. With an annual policy, you just have to buy it once and you'll be covered for the rest of your trips for the next 12 months (as long as you

Looking for the best annual travel insurance?

Based on popularity, here are the top 6 brands that people choose from Finder for their annual travel insurance.

| Brand | Maximum trip duration options | Maximum age limit | Overseas medical expenses | Cancellation expenses | Apply |

|---|---|---|---|---|---|

|

| No Age Limit | Unlimited | Chosen Cover | Get quote |

1cover 1cover |

| Under 64 | Unlimited | Unlimited | |

|

| Under 74 | $5,000,000 | Chosen cover | |

Budget Direct Budget Direct |

| Under 75 | Unlimited | Unlimited | |

Insure4less Insure4less |

| Under 66 | Unlimited | $7,500 | |

Online Travel Insurance Online Travel Insurance |

| 74 years and under | Unlimited | Chosen cover |

*These are the top 6 brands for annual multi-trip policies on Finder between October 2018 - 2019. Limits are for their top level of cover.

How to compare annual travel insurance

Before you start comparing, there are some critical points to consider such as destinations, trip durations and age limits.

- Destinations. Just like normal travel insurance, the price you pay will depend on where you intend ongoing. If you're trying to save money, you can list out specific destinations and get a premium for those places only. If you're going for convenience, select "Worldwide" and you'll be covered for all destinations - including domestic travel, and it's really not that much more expensive for most insurers.

- Trip duration. Annual multi-trip policies will only cover you for the maximum trip duration that you choose at the time you buy the policy. It can vary amongst different brands but it can range from 15 days up to 90 days.

- Age limits. Most brands have an age limit on who can take out an annual policy which is usually around the mid-70s. If you're older you can still get cover but it might be limited to only a few brands.

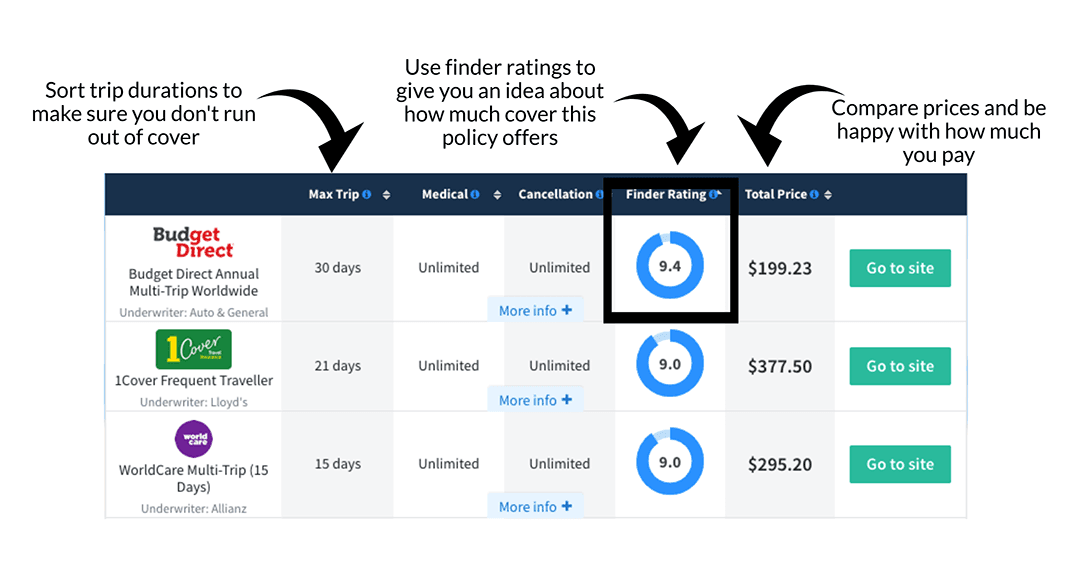

Now that you've made all the important considerations, you can start comparing! Using our comparison tool:

- Enter your destination

- Enter the departure date of your first trip

- Enter your age

- Then get your quote

- Use the sorting tool to choose a trip duration that's suitable for you

- Use the finder rating to help you choose a level of cover

- Choose a price that suits your budget

This is how your annual travel insurance comparison will appear.

How much does it cost?

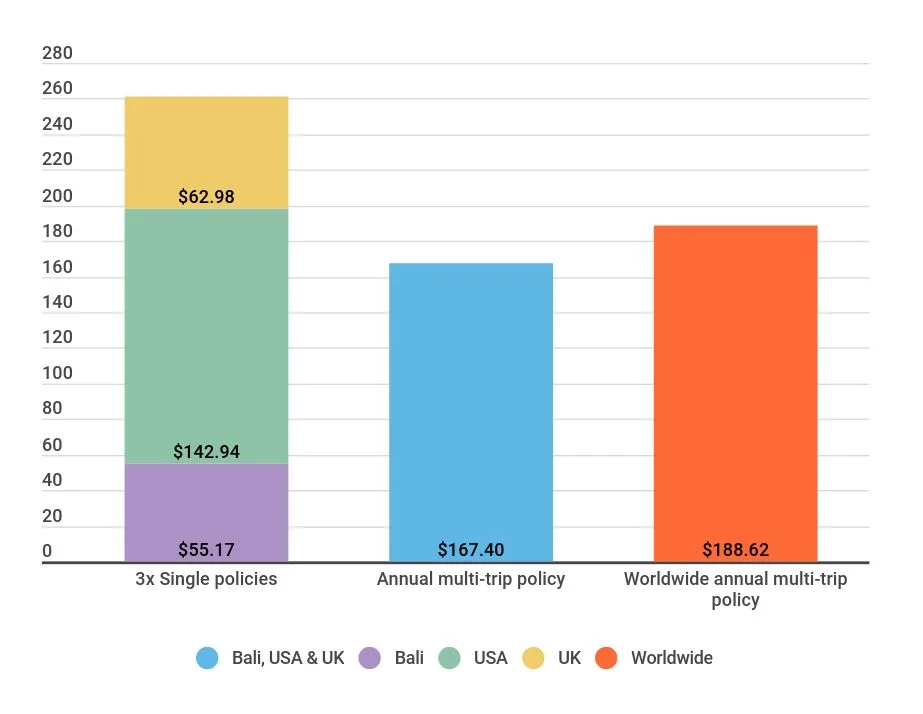

Say you take three trips over the course of the year - one week in Bali, three weeks in the US and three weeks in the UK. If you purchase a comprehensive single trip policy with Budget Direct (Finder's top-rated travel insurance policy) for each trip, you're looking at a combined cost of $261.09*. However, Budget Direct's Annual Multi-Trip policy costs $167.40* - meaning you're looking at savings of $93.69.

Better yet, if you opt for a Worldwide annual multi-trip policy from Budget Direct, it's only $21.22 more. Then you won't have to restricted by countries and you'll be covered for trips that weren't expected at the time you bought your policy.

*Prices are based on 30 year old traveller with an excess of $200, as of October 2019.

Annual multi trip travel insurance comparison

Before choosing your policy, consider the maximum duration of each of your trips. Some brands will let you travel for up to 90 days while others will only let you travel up to 30 days. Check out the comparison of annual travel insurance policies from Finder partners below.

| Brand | International individual trip duration options | Domestic individual trip duration options | Maximum Age | Apply |

|---|---|---|---|---|

|

|

| All ages | Get quote |

|

| 64 | ||

|

| 70 and 70+ | ||

American Express American Express |

|

| 69 | |

|

| 74 | ||

|

| 69 | ||

|

| 64 | ||

|

| 100 | ||

|

| 70 | ||

|

| Not stated on the PDS | ||

Online Travel Online Travel |

|

| 74 | |

Travel Insuranz Travel Insuranz |

|

| 70 | |

|

| 74 | ||

|

| 74 | ||

|

| 74 | ||

|

|

| 74 | |

|

| 69 |

What's included?

Multi-trip travel insurance covers all the same things as a single-trip policy. This means you can expect cover for:

- Cruise and Ski cover. Some annual travel insurance policies automatically include cruise and ski cover in their policies. If you plan to go on a cruise or ski during one of your trips, go for a policy that includes these services.

- Medical expenses including evacuation. If you get sick or injured while overseas, your policy will cover the cost of your ambulance, hospital bed, surgery fees and evacuation to the nearest hospital (or back to Australia if necessary). Most annual policies offer unlimited medical for international trips, which helps with peace of mind knowing you're covered no matter where you go.

- Additional emergency expenses. This covers the additional travel and accommodation expenses related to emergencies outside of your control, like becoming medically unfit to travel or the unexpected death of a close relative back home. Most policies will also pay for someone in Australia to travel to you if you're hospitalised overseas.

- Cancellation fees and lost deposits. This covers your non-refundable pre-paid travel expenses and any cancellation fees if you have to cancel your trip due to unexpected events outside of your control.

- Luggage and personal belongings. Covers the repair or replacement costs for luggage and personal items are lost, stolen or damaged during your trip. Some policies will pay you an emergency allowance to help you purchase essential clothing and toiletries if an airline temporarily misplaces your luggage.

- Travel delay. This pays for unexpected meal and accommodation costs when your flight or other prepaid transportation is rescheduled or delayed for a significant amount of time.

- Rental vehicle excess insurance. This brings down the unreasonably high excess car rental companies charge if you damage one of their cars. Some policies offer this for free. Others charge extra for it.

- Personal liability. This pays your legal fees and penalties if you accidentally injure someone or damage their property while travelling.

What's not included?

All policies have a list of exclusions, which outlines what your policy won't cover and what situations will void your policy. You can check out our guide to travel insurance exclusions for a thorough rundown, but here are some of the most common exclusions you'll find:

- You're travelling somewhere there's a travel warning. The Australian Government issues advisories for a reason. If you choose to travel to these countries and ignore these warnings, your insurance will be invalid.

- You don't take care of your belongings. Your insurer won't pay for lost items if you weren't careful with them. This includes leaving your luggage or valuables unattended or leaving your hotel room unlocked.

- You're taking part in extreme or dangerous activities. Most policies won't cover extreme sports or other dangerous activities such as base jumping or mountaineering.

- You were acting recklessly. Your insurer can deny your claim if they find you were acting recklessly at the time. This can include being drunk, being high, breaking the law or putting yourself in harm's way.

- Illness or injury from pre-existing conditions. If you fail to disclose any pre-existing conditions, your insurer could deny medical claims if they think the new injury or illness is related.

- You're pregnant. Most policies will not cover childbirth at all and they'll stop covering pregnancy-related complications up to a certain point in the pregnancy (varies from insurer to insurer). However, they will cover all unrelated medical conditions like a broken wrist for the duration of the trip.

Compare annual multi-trip travel insurance

Not sure where you'll be travelling to? Just enter "worldwide" into the destination box.

Made a search before? Retrieve your search results

Type or Select your destination(s)

Popular Destinations

- Americas

- Asia

- Europe

- Pacific

- Africa

Questions you might have about annual travel insurance

Compare annual policies from different brands

Continue reading:

Icons made by Vectors Market, Freepik, Icon Pond, Pixel Buddha, Freepik from www.flaticon.com is licensed by CC 3.0 BY

Picture: Unsplash

Picture: GettyImages

Ask an Expert

Please send quotes for comprehensive annual travel insurance. Travel several times a year for personal travel and conference – international and local. Sometimes travel together and other times independently. We are both healthy.

Hi Sam,

Thank you for getting in touch with finder.

Since you need to start comparing your travel insurance options, kindly enter all details asked on the table such as where you’re going to, age of travellers and date of your first trip then click on the get quote green button. The page will then show quotes and you may filter your search including level of cover – Basic, Standard and Comprehensive, as well as required cover options. Once you have chosen an insurer, please click on the green go to site button to be redirected to the provider’s official page to learn more on the multi-trip travel insurance they offer or even start your online application.

I hope this helps.

Thank you and have a wonderful day!

Cheers,

Jeni

I will be travelling to South Africa in August then cruising from Barcelona to Dubai in November. Can I get annual insurance to include both?

Hi Catherine,

Thank you for getting in touch with finder.

Yes, they are included in an annual multi-trip travel insurance. It covers you for as many trips as you can fit into an entire year with just one policy paid for upfront.

I hope this helps.

Please feel free to reach out to us if you have any other enquiries.

Thank you and have a wonderful day!

Cheers,

Jeni

Age is 76 years Still working Would like Annual policy mixture of work and pleasure trips Work 10 Days (av) and pleasure 35 Max Days

Hi David,

Thanks for your inquiry.

To search and compare annual multi-trip travel insurance, kindly enter the dates of travel and your destination to generate quotes for your travel insurance options.

When you are ready, you may then click on the “Go to site” button and you will be redirected to the insurer’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Before applying, please ensure that you read through the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

I hope this helps.

Thanks,

Jonathan

I travel to Europe for pleasure typically from

Apr-Oct each year..sometimes stopping off in Asia on the way. What is the best insurance to cover me for this length of time? I do not always book my trip originating from Australia…sometimes it can originate from Europe. My partner is not an Australian resident (European).

Hi Des,

Thanks for reaching out.

Here at finder we are unable to give recommendations, we can offer general advise.

The page you visited is accurate as it will allow you to compare qoutes between insurers. You just need to enter you details and all the destinations you will be going to and from there you can receive qoutes.

While annual travel insurance covers an unlimited number of trips, there is a limit to the maximum duration of each individual trip. This limit varies from one insurer to the next, but you’ll often have several options to choose from. For example, you may be able to choose a maximum individual trip limit of 30, 60 or 90 days.

It would be best to check on the level of cover first and contact the insurer you are interested in to make sure all your questions are answered that way you select the insurance that would suit you best.

Cheers,

Joanne

I want to find a combined annual multi trip policy for myself and my husband. But we won’t be travelling on all the same trips throughout the year. Please can you tell me which policies cover this? I know there are some that do,I just don’t know which ones.

Hi Jean83,

Thanks for your question. GoInsurance provide this cover only on the Go Plus level of cover. With 1Cover you are able to put two adults on an annual policy as it allows cover for you both individually. However, you must travel together for more than 75% of your trips and not exceed 90 days for a single trip.

This is in no way a comprehensive list of the cover options available nor is it an endorsement of these products. You should carefully consider your needs and review the product prior to making a decision.

I hope this was helpful,

Richard